Billion Dollar Burnouts: Unraveling 5 Tech IPO Disasters

IPOs mask challenges: rates, revenue, worries. Investors seek stability; internal issues raise doubts.

The excitement surrounding initial public offerings (IPOs) often paints a picture of soaring success, promising growth, and financial triumph. However, the landscape of technology startups is riddled with cautionary tales where euphoric IPOs were followed by unforeseen downturns.

Several factors have conspired to sink share prices of recently listed startups, from a broader shift in investor risk appetite as interest rates rise, to industry-specific concerns about their path to profitability. Worried about economic uncertainty, investors might be demanding steadier, cash-generating businesses, making growth-at-all-costs tech narratives less appealing. Meanwhile, internal factors like shaky revenue models and missed targets add to the negative sentiment, highlighting concerns about their long-term sustainability

WeBuy (NASDAQ: WBUY)

Webuy is an e-commerce retailer company founded in 2019. Based in Singapore, it serves the Singapore, Indonesia, and Malaysia market, selling products and services through its platform that runs on a group buying model. Group buying model works by allowing several people to sign up on the platform and get connected to each other to approach a vendor of a specific item to collectively bargain for a lower rate. Since its founding date, WeBuy has raised a total of USD 9 million from Global Founders Capital (Seed & Series A), Wavemaker Partners (Series A) and Centauri Fund (Series A) before going public in Oct 2023, raising USD 15.2 million. In March 2022, WeBuy acquired its counterpart, Chilibeli for an undisclosed purchase price as part of its expansion strategy to Indonesia market.

WeBuy shares price take flight in the first day of its trading, almost doubling before closing at USD 5.34 a 33.5% increase. However, the shares prices quickly fallen by 28.8% to USD 3.80 in the next day. As of December 18, 2023, two months after the IPO, WeBuy is trading at only USD 0.65, a 83.33% decrease from its IPO price. For the year 2022, WeBuy reported USD 44.56 million revenue which was a 99.86% growth from 2021. However, the growth seems to be slowing down in the first half of 2023 with reported revenue of USD 24.4 million which was 62% increase from first half of 2022.

Peloton (NASDAQ:PTON)

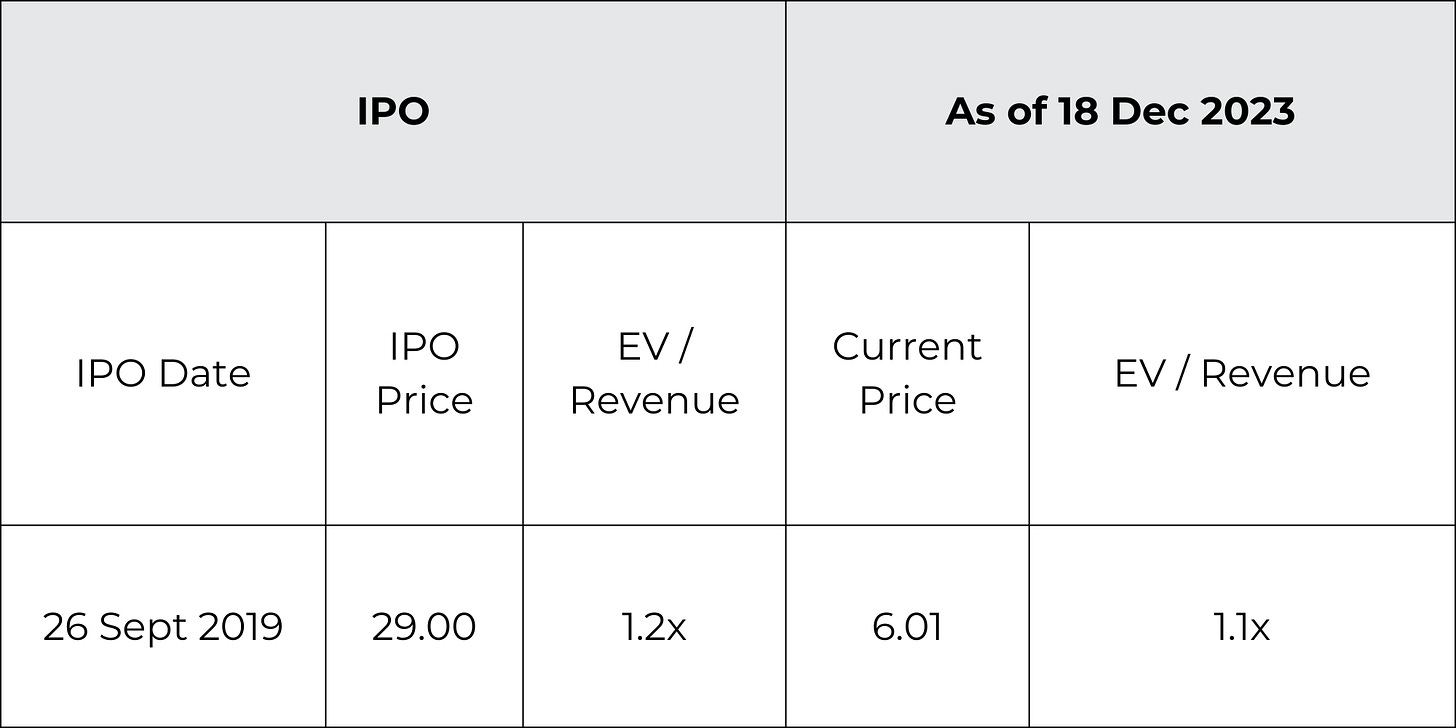

Peloton, the innovative US fitness startup, has undergone a bumpy journey in recent years. Initially admired for reshaping fitness through its interactive platform with live and on-demand studio classes, Peloton secured substantial investments, including around USD 1 billion from Tiger Global Management, L Catterton, Fidelity, TCV, and other investors before its IPO. Seven years after founded, the company went public on Nasdaq in September 2019, raising USD 1.16 billion. Initially trading at USD 29.00, Peloton's stock surged to USD 162.72 in December 2020. However, challenges emerged, starting in 2020 with logistical struggles causing delivery delays amid surging demand. Simultaneously, the company faced customer dissatisfaction due to issues with its bike product, prompting a recall of 30,000 bikes.

Peloton encountered further setbacks in 2021, including an incident involving a child and its treadmill. To enhance treadmill safety, Peloton’s carrying out a USD 39 monthly subscription, which sparked outrage. The culmination of these issues, coupled with the easing of pandemic restrictions, led to a decline in Peloton's fortunes. The company responded with significant measures, including laying off over 5,200 employees and a change in leadership. CEO and Founder John Foley stepped down, making way for Barry McCarthy, former CFO of Spotify and Netflix. Currently facing stock challenges with a price of USD 6.01, Peloton aims to rebound by exploring partnerships with businesses, hotels, and gyms.

Beyond Meat (NASDAQ: BYND)

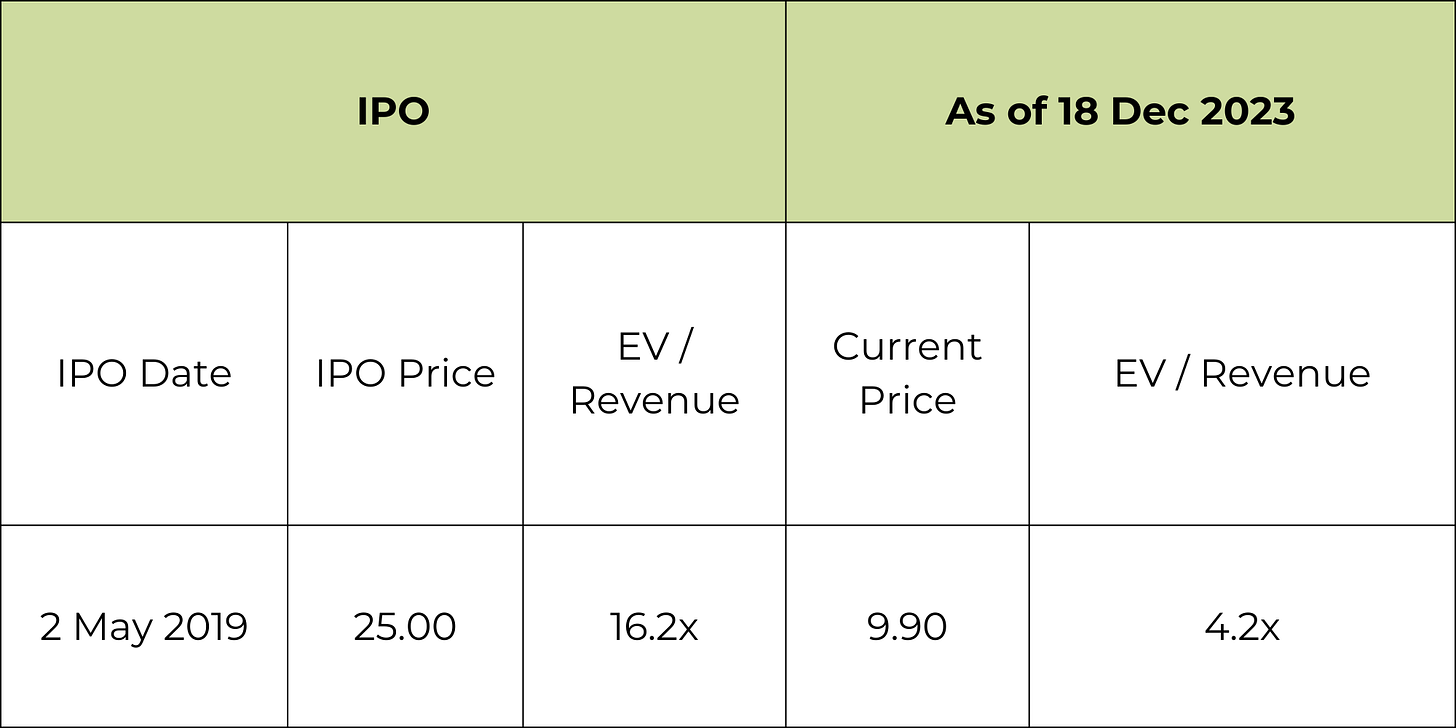

Beyond Meat, a US-based food processing company specializing in plant-based meat alternatives, made headlines before its IPO by securing over USD 150 million in funding from investors like Future Positive, Structural Capital, and Cleveland Avenue. The company went public in May 2019, raising USD 241 million with an opening share price of USD 25.00. Achieving an all-time high of USD 234.90 in July 2019, Beyond Meat's stock began fluctuating before experiencing a continuous decline from June 2021 onward.

The challenges faced by Beyond Meat are attributed to two main factors: internal instability and the struggle to meet earnings expectations. The company witnessed executive shake-ups, with its Chief Operating Officer, Chief Financial Officer, and Chief Growth Officer departing in October 2021, contributing to internal uncertainties. In terms of financial performance, Beyond Meat reported a concerning 26% revenue decline in 9M 2023 compared to 9M 2021, falling from USD 364 million to USD 270 million. In addition, the startup’s revenue has always been short of analyst expectation in every quarter since 2021. The struggles in earnings have been affected by the increased competition in the market with big names like Tyson Foods and Nestle and up and coming startups like Impossible Food and Quorn entering the market. These struggles has caused investors to loss confident in Beyond Meat.

Lemonade (NYSE: LMND)

Lemonade is a digital insurance company based in the US that provides various insurance products in the United States and Europe. Its insurance products include stolen or damaged property, and personal liability that protects its customers if they are responsible for an accident or damage to another person or their property. The company also offers renters, homeowners, car, pet, and life insurance products, as well as landlord insurance policies. Lemonade replaces insurance brokers & paper bureaucracy with bots and machine learning, delivering zero paperwork and seamless process. Lemonade has raised a total of USD 631.5 million in funding over 10 rounds from SoftBank, Google Ventures, Allianz, among other investors. Their latest funding was raised on Jul 2, 2023 from a Post-IPO Equity round of USD 150 million.

In the first day of trading, LMND shares soared 73% from USD 29.00 per shares to over USD 50.06 per shares on its first go-public day and climbing to an all-time high of USD 183.26 in January 2011. But as of today, the stock is worth only USD 17.23 per share. As with many startups, Lemonade is struggling to book a profit. As of Q3 2023, Lemonade is still booking a net loss of USD 62 million. On top of this persistent loss, the customer growth kept decelerating since its IPO with 2020 to 2021 growth of 43%, while 2021 to 2022 growth of only 27%. At this decreasing rate, it seems unlikely Lemonade may book its profit or even positive EBITDA in the near future.

Instacart (NASDAQ: CART)

Instacart, an online grocery platform facilitating same-day delivery and pickup services for both retailers and consumers, garnered significant pre-IPO funding totaling USD 2.9 billion from investors including Sequoia. The company went public in September 2023, raising USD 660 million, but has faced a downturn since its stock debut at USD 30.00, currently settling at USD 25.10.

According to Aswath Damodaran, a finance professor at NYU's Stern Business School, several factors contribute to the decline in Instacart's stock value. First, the grocery industry's slim profit margins provide limited fee-generating opportunities for startups like Instacart, particularly with its 7.5% take rate, notably lower than other businesses such as publicly-traded food delivery platform Doordash, which boast take rates exceeding 10%. Second, a shift in consumer behavior back to personal grocery shopping after the pandemic has impacted demand for Instacart's services, particularly for non-processed foods where customers prefer the hands-on shopping experience as they will be able to see and touch the product before making a purchase. Damodaran also notes the inherent growth limitations in the online grocery retail sector, presenting challenges for Instacart. Lastly, the company's compensation model for shoppers, based on individual orders and deliveries, hinders the realization of economies of scale, resulting from inevitable high costs. Those factors have dragged the startup’s stock price down despite recent effort of expanding their business through ads and other measures, as mentioned in the “Trends That Rise and Fall” segment of this article.

Journey of AI Development