Digital Banking as the New Normal

Traditional banks are faced with the urgent challenge to digitally transform their services to keep up with customer demands.

2020 delivered unexpected changes and challenges, including in the way people bank. While an increased emphasis on digital was already underway before the pandemic, limited branch access and the public fear of contaminated paper bills have fast-tracked the changing relationship between consumers and their financial institutions. Globally, the adoption of digital banking has continued to rise.

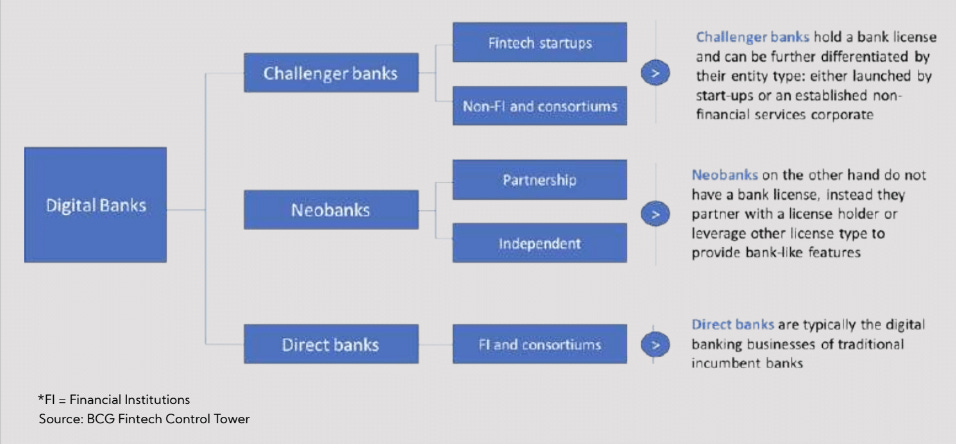

A digital bank is one that offers the same type of banking services such as a traditional bank except it operates predominantly online, so customers can control their finances entirely from their smartphones and computers.

Today, there is a solid group of digital banks that are providing convenient and useful services to customers.

AMERICA

CHIME

Founded: 2013

Headquarter: San Francisco, California

Total assets: $5.8 billion (2019)

Customer base: 12 million (Jan 2021)

VARO BANK

Founded: 2015

Headquarter: San Francisco, California

Total assets: Undisclosed

Customer base: ~2 million (Jan 2021)

NUBANK

Founded: 2015

Headquarter: Sao Paulo, Brazil

Total assets: $4.8 billion (2019)

Customer base: 34 million (Jan 2021)

EUROPE

N26

Founded: 2013

Headquarter: Berlin, Germany

Total assets: $1.3 billion (2018)

Customer base: 5 million (Jan 2021)

REVOLUT

Founded: 2015

Headquarter: London, England

Total assets: $3.5 billion (2019)

Customer base: 12 million (Dec 2020)

MONZO

Founded: 2015

Headquarter: London, England

Total assets: $850 million (2019)

Customer base: 4 million (Nov 2020)

ASIA

WEBANK

Founded: 2014

Headquarter: Shenzhen, China

Total assets: $46.5 billion (2019)

Customer base: 200 million (Nov 2020)

PAYTM BANK

Founded: 2010

Headquarter: Noida, India

Total assets: Undisclosed

Customer base: 5 8million (Jan 2021)

MYBANK

Founded: 2015

Headquarter: Hangzhou, China

Total assets: $14.9 billion (2018)

Customer base: 20.9 million SMEs (2019)

SOUTHEAST ASIA

ASPIRE

Founded: 2018

Headquarter: Singapore

Total funding amount: $41.5 million (as of Feb 2021)

TONIK

Founded: 2018

Headquarter: Singapore

Total funding amount: $27 million (as of Feb 2021)

TIMO

Founded: 2015

Headquarter: Ho Chi Minh City, Vietnam

Total funding amount: Est. 450.000 accounts (2020)

In the 10-country ASEAN region of over 660 million in total population, the demographics skew towards the younger generation with eight of the countries have median ages of 30 or lower including Indonesia, Philippines, Vietnam, and Malaysia. Digital banks appeal strongly to younger, Gen Y and millennial customers. These digital natives don’t typically find reassurance in having a physical branch nearby – many would prefer not to visit one.

Recently in December 2020, the Monetary Authority of Singapore awarded two digital full bank licenses to Singtel & Grab and Sea Limited, and two digital wholesale bank licenses to Ant Financial and the Greenland Financial Holdings consortium. In 2019, London-based Revolut opened its doors in Singapore, followed by the launch of their kids-specialized financial app called Revolut Junior in the country in February 2021.

Indonesia is a market ripe for digital banking because of its largely unbanked population and high mobile penetration rate. According to Bank Indonesia, the country is forecasted to record double-digit growth in digital transactions of 19.1 percent YoY to IDR 32.2 quadrillion in 2021, much faster than 1.5 percent YoY between 2019 and the estimated 2020 figure. To keep pace with growing demands, traditional banks with legacy models are faced with the urgent challenge to digitally transform their services as the pandemic intensifies both consumers and businesses’ need for availability, access, and control of digital banking services.

Below are the top ten banks in Indonesia by asset in 2020 with their respective digital and/or mobile banking propositions:

Bank BRI - BRImo

IDX: BBRI

Total assets: $107.6 billion (Dec 2020)

PT Bank Rakyat Indonesia (Persero) Tbk specializes in small scale and micro finance style borrowing and lending. In 2019, the bank launched its latest digital banking application called BRImo that combines the functionalities of mobile banking, internet baking, and e-money. It is also currently exploring the possibility of changing the business model of its subsidiary, namely PT Bank Rakyat Indonesia Agroniaga Tbk, into a digital bank.

Mandiri - Mandiri Online

IDX: BMRI

Total assets: $101.6 billion (Dec 2020)

PT Bank Mandiri Tbk is one of the top four largest banks in Indonesia. In 2021, the bank is allocating IDR 2 trillion worth of capital expenditure for the development of its digital banking initiatives, including Mandiri Online, to strengthen its position in the market. Additionally, it is also collaborating with Alibaba Group’s digital wallet Alipay as well as leading ride-hailing platform Grab to expand its reach.

BCA - BCA Digital*

IDX: BBCA

Total assets: $76.6 billion (Dec 2020)

PT Bank Central Asia Tbk (BCA) is the largest bank by market capitalization in Indonesia that is majority-owned by the Djarum Group, one of Indonesia’s largest conglomerates. The bank plans to launch its new subsidiary BCA Digital Bank in the first half of 2021 after it acquired Bank Royal for IDR 988 billion at the end of 2019. BCA Digital will not have any physical presence, and every transaction will go through the BCA network.

*Separate entity from parent company

BNI - BNI Mobile Banking

IDX: BBNI

Total assets: $63.5 billion (Dec 2020)

PT Bank Negara Indonesia Tbk was initially the central bank of Indonesia before becoming a commercial bank. It is the first state-owned bank to go public on theIndonesia Stock Exchange (IDX). As part of the bank’s digitalization initiatives, the bank opened e-branches equipped with BNI SONIC (self service account opening)machines in 2019. The number of the bank’s mobile banking users went up by 60 percent to 7,787 million users in 2020 from 4,878 million users in the previous year.

Bank BTN - BTN Mobile Banking

IDX: BBTN

Total assets: $25.7 billion (Dec 2020)

PT Bank Tabungan Negara Tbk was the first bank appointed by the government to provide housing finance and mortgages to low and middle-income individuals. In 2020, the bank recorded an increase of at least 35 percent in its mobile banking users and an increase of almost 40 percent in its transaction volume. Even though the bank is focusing on digitalization and increasing its online transaction volume, it said that it has no plans in becoming a digital bank

CIMB Niaga - OCTO Mobile

IDX: BNGA

Total assets: $20.06 billion (Sept 2020)

PT Bank CIMB Niaga Tbk is majority-owned by theMalaysian universal bank CIMB Group after being acquired in 2002. In 1991, it was the first bank to provide online banking facilities in Indonesia. In June 2020, the bank renamed its internet banking to OCTO Clicks. In addition to OCTO Clicks and mobile platform OCTOMobile, the bank is developing CIMB Niaga API to facilitate OCTO Cash that will enable a quick payment to e-commerces and other startup platforms

PaninBank - Mobile Panin

IDX: PNBN

Total assets: $15.4 billion (Sep 2020)

PT Bank Panin Tbk was formed from the merger of Bank Kemakmuran, Bank Industri Jaya, and Bank Industri Dagang Indonesia. Its business strategy focuses on the retail banking segment, specifically in consumer and commercial products. In 2019, the bank allocated $12 million budget to expand its digital services, starting with the launch of Mobile Panin. They have also prepared a road map for their digital banking initiative with the initial phase planned to be launched in mid 2021.

OCBC NISP - ONe Mobile

IDX: NISP

Total assets: $14.7 billion (Dec 2020)

PT Bank OCBC NISP Tbk is majority-owned by theSingaporean banking and financial group OCBC Bank. In 2018, OCBC NISP launched ONe Mobile which provides not only transactional services but also financial management tools. During the pandemic, the bank introduced Nyala, a program that encourages millennials to save and invest from as little as $2 a day by setting up auto-debit through ONe Mobile.

Bank Danamon - D-Bank

IDX: BDMN

Total assets: $14.4 billion (Dec 2020)

PT Bank Danamon Indonesia Tbk is majority-owned byJapan’s largest bank Mitsubishi UFJ Financial Group (MUFG). The bank first launched its mobile application D-Bank in November 2014. In January 2019, the bank released the D-Bank Registration feature to allow prospective customers open accounts online and complete the verification process virtually. For this innovation, the bank won the Asia Trailblazer Award by Retail Banker International (RBI) in October 2020.

Bank BTPN - Jenius

IDX: BTPN

Total assets: $13.3 billion (Sep 2020)

PT Bank BTPN Tbk was founded by the members of the Perkumpulan Bank Pegawai Pensiunan Militer (BAPEMIL) with the goal of easing the economic burden of both veteran and civilian retirees and in 2019, the bank officially merged with Bank Sumitomo Mitsui Indonesia. In 2016, BTPN launched their digital banking service called Jenius with the theme “Banking Reinvented” after 18 months of development and IDR 500 billion in investments. The number of account holders was said to have reached 2.7 million with IDR 10 trillion in deposits as of 2020.

Meanwhile, big techs such as Gojek and Shopee are also fast encroaching into the same space for a share of the pie.

Akulaku - Bank Neo Commerce

IDX: BBYB

Market capitalization: $280 million (18 Feb 2021)

Total assets: $306 million (Sep 2020)

After changing its name from PT Bank Yudha Bakti to PTBank Neo Commerce and getting upgraded to BUKU II category in September 2020, the bank was ready to transform into a digital bank. It was said to be developing their digital banking system with Huawei and Sunline as of November 2020.

Gojek - Bank Jago

IDX: ARTO

Market capitalization: $6.6 billion (18 Feb 2021)

Total assets: $123 million (Sep 2020)

In December 2020, Gojek increased its ownership in Bank Jago (previously named Bank Artos Indonesia) to 22.2percent, paying $0.081 per share for a total purchase of $159 million. The publicly listed bank is turning itself into a digital bank and plans to partner with all platforms in the digital ecosystem.

Sea Group - Bank BKE

Total assets: $325 million (Aug 2020)

In January 2021, the parent company of Shopee, SeaGroup, acquired a majority stake in Bank Sejahtera Bersama Kami (BKE) to offer loans and other financial services online.

The evolving and fragmented regulatory landscape across the ASEAN region could pose some hurdles. Nevertheless, the increasing competition in digital banking indicates the bright prospects of this industry that is only entering its early growth phase in Indonesia. For banks, developing a digital bank is imperative to keep up with customer demands and to remain relevant in the market. In this race of banks reinventing themselves and technologically savvy neo banks, who will emerge the winner?