Filing for a Bankruptcy in Indonesia

In Indonesia, the legal framework for bankruptcy is governed by the UU No.37/2004 on Bankruptcy and Suspension of Debt Payment Obligations is Indonesia's current bankruptcy statute (penundaan kewajiban pembayaran utang/ “PKPU”).

In 2022, 520 petitions of PKPU cases were registered in the case monitoring system or Sistem Informasi Penelusuran Perkara (“SIPP”) of the commercial courts in Indonesia in 2022. A considerable post-Covid drop in the number of cases, where prior to 2022, 732 case were reported in 2021, from the 637 instances reported in 2020 and the 425 instances reported in 2019.

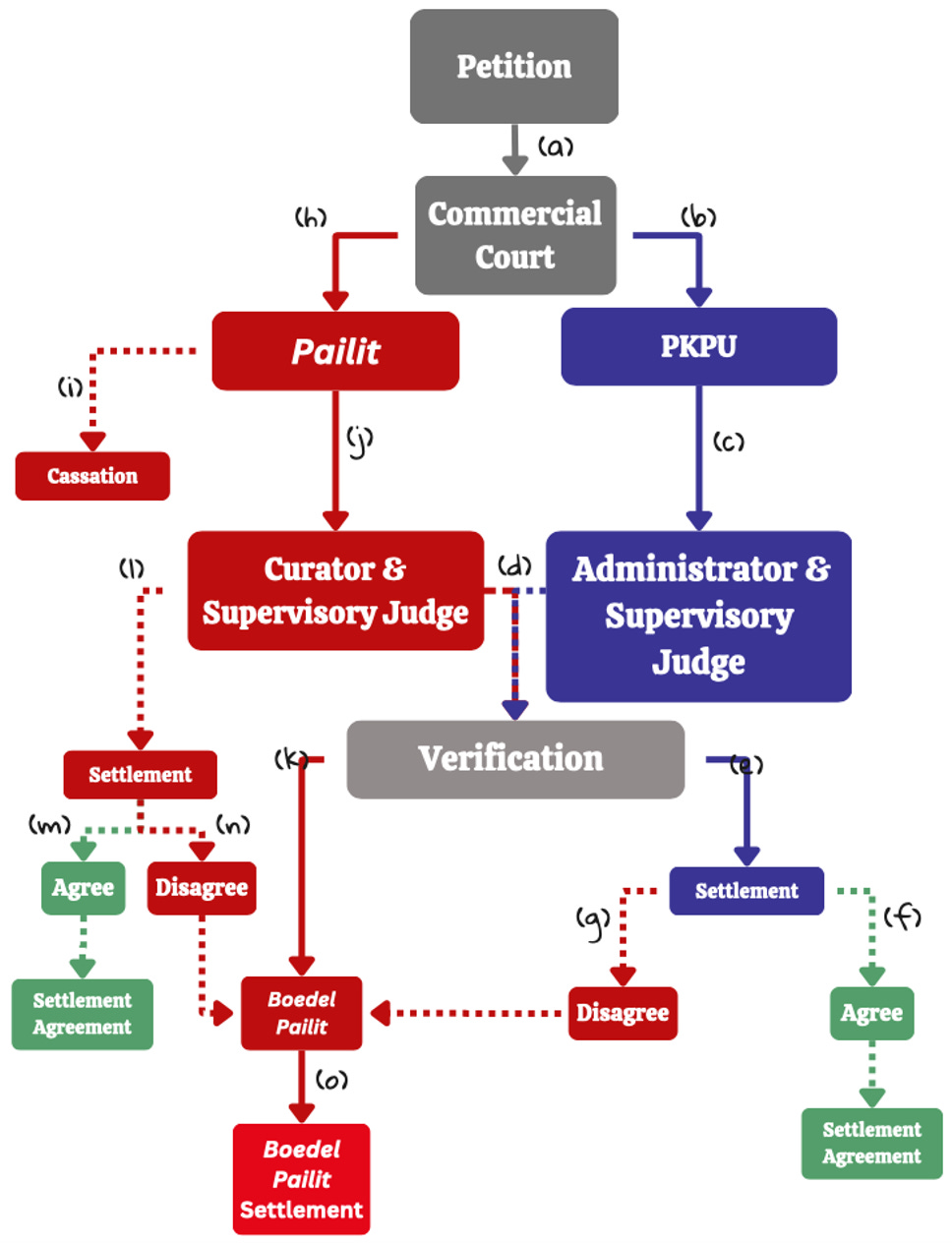

Bankruptcy Flow in Indonesia

In general, the Law 37/2004 (bankruptcy law) governs two categories of legal actions: bankruptcy (pailit) and PKPU. The chart above takes a closer look on the flow of these legal actions concerning businesses unable to fulfill their liabilities.

Commercial Court (Pengadilan Niaga) (a)

Debtors or creditors petition a file to the commercial court to take legal action on debtor’s inability to pay its debts. Petition from creditors commonly go straight to pailit, while petition from debtors often demands PKPU (suspension of payments) (b).

If PKPU is Granted

If the court grants the PKPU petition, a supervisory judge and administrators are appointed for the case (c). The administrator(s) or curators verify the creditors’ receivables with the debtor’s payables, enforce the debtor to propose a settlement plan for the creditors in a PKPU case, and publish the court decision on PKPU/pailit in at least two media outlets, local and nationwide. The supervisory judge then declares the amount to be paid (d).

The debtor proposes a settlement plan to the creditors until both parties agree to the settlement plan and set an agreement for terms of payment (e&f). If the proposal is unsatisfactory for the creditors, or the debtor is unable to fulfill their obligations in the previously agreed terms, the debtor is declared pailit, and their assets are seized, becoming boedel pailit [assets of debtor declared as bankrupt] (g).

If Declared Bankrupt

If the court grants the pailit petition, the debtor may file for cassation (i), which moves the case from the commercial court level to a higher court level, Mahkamah Agung (Supreme Court). If no cassation is filed, the court will appoint a supervisory judge and curator for the case (j), and the debtor’s assets are seized (k). The debtor may file for settlement with creditors if approved (l). If the debtor’s settlement proposal is accepted by creditors, the debtor is declared debt-free (m). However, if the proposal is declined, the debtor will be declared pailit (n), and have their assets seized, becoming boedel pailit, and the court decides on how the boedel pailit are sold, commonly by auctioning, and sets the terms for creditors (o).

OCBC NISP Ventura

April 2023 Newsletter