Forks, Funds, and Food: VC Investments in the F&B Industry

The food and beverage industry, known for its stability but challenged by evolving trends, has seen limited venture capital investments, raising doubts about investor interest in the sector.

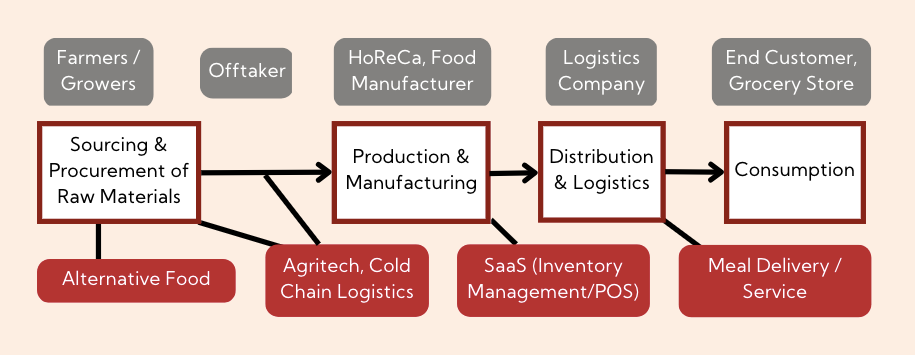

The Food and Beverage (F&B) industry includes all the companies involved in transforming raw agricultural goods into consumer food products. However, in this article, our focus area will be within the foodservice industry, which are businesses and organizations that prepare and serve food and beverages to customers, including restaurants, cafes, bars, catering companies, hotels, and other F&B providers.

The F&B market is globally considered one of the most stable, recession-proof industries, as F&B are essential human needs. This stability is particularly evident in Indonesia’s F&B market, which has shown resilience in the face of economic and social challenges shown during the heights of the Covid-19 pandemic. This is exemplified by the industry’s consistent expansion, with the Indonesian food revenue rising from USD 208.57 billion in 2018 (pre-pandemic) to USD 258.44 billion in 2021 (post-pandemic), at Compound Annual Growth Rate (CAGR) of 7.4%.

Indonesia’s F&B market has experienced significant growth in recent years, in parallel with the country’s strong economic and rising middle class. In 2022, the revenue generated by Indonesia’s food market amounted to USD 264.79 billion. Analysts predict that this figure will continue to rise in 2023, reaching USD 289.30 billion and further increase to USD 366.74 billion by 2027, with 6.11% CAGR.

Source: Statista

Despite its significant contribution to the economy and employment, VC investments within the F&B industry have been relatively limited, prompting one to question whether VC investors simply do not have appetite for the sector. For one, the F&B business is known to be highly challenging due to its sensitivity to constantly changing trends. Consumer preferences and tastes are constantly evolving, making it difficult for businesses to keep up and remain relevant. What may be popular one day may be out of favor the next. The following figure illustrates the popular booms of food and drink products in Indonesia year after year, with many of these brands becoming less relevant and even closing a significant number of outlets not long after.

In addition, the F&B industry has shown limited technological innovation compared to other sectors; many of which have failed to monetize and stay in business. Think about the time Zomato was the go-to food directory app in the country, followed by the frenzy of Zomato Gold, which offered its subscribers special discounts when dining with restaurant partners. Now we simply rely on food bloggers for recommendations and Google for reviews and directions. Think about Chope, which has been around for years and years and still struggle to penetrate the market since many Indonesians prefer the manual workings of reservations via WhatsApp. Think about Traveloka Eats, Traveloka’s online food delivery service that lasted less than four years. These players were and some are still backed by some of the biggest names in the world, but discounts and incentives can only get you so far and loyalty to an app seems hard to come by in this country.

Conventional or not, the F&B business is difficult.

Yet despite the grueling stories we are familiar with, the industry remains innovative, now more focused on optimizing the backend operations of the F&B businesses. Here are some of the key trends we have seen within the F&B sector recently:

Early Adoption of Dine-in Mobile Ordering Systems

If you have recently dined out, you may have noticed that many restaurants now have a QR code pasted on the corner of the tables or on the table talkers. In the rapidly evolving industry, startups like Esensi Solusi Buana (ESB) and Desty are making waves by developing mobile ordering and payment systems that enable restaurants to move to digital menus and ordering systems. These innovative solutions are transforming the way foodservice businesses operate, helping them to streamline their processes, enhance customer experiences, and improve operational efficiency.

These systems offer several advantages for both customers and restaurant owners. For customers, mobile ordering provides seamless and convenient experience, allowing them to browse menus, customize their orders, and place them with just a few taps on their smartphones. This reduces the need to wait around for available waiter service, which is especially useful during peak hours.

From the restaurant’s perspective, mobile ordering and payment systems can improve operational efficiency. They reduce errors in order taking, streamline communication between the front-end and back-end staff, and facilitate faster table turnover.

In this highly competitive landscape, these startups are constantly seeking ways to attract customers by providing discounts and incentives to their customers. These incentives may include discounted or waived fees, promotional campaigns, or other perks. While loyalty to a specific online order system may offer benefits such as familiarity and streamlined operations, the allure of incentives may overshadow these considerations. As a result, F&B businesses may not demonstrate long-term loyalty to a particular online order system. They may be willing to switch platforms if they perceive a better opportunity for cost savings or even develop their own platform when no more incentives are in place.

As the adoption of mobile ordering and payment systems continues to evolve in Indonesia, it is expected that more restaurants will recognize the value of these solutions and embrace the digital transformation. The convenience, efficiency, and potential cost savings associated with mobile ordering and payment systems make them an attractive option for enhancing the dining experience.

Affordable Coffee On-The-Go

In recent years, Indonesia has witnessed the rise of a new and exciting trend in its coffee industry: the emergence of affordable coffee brands. This trend gained momentum following the success of Kopi Kenangan, a local coffee chain that revolutionized the market and paced the way for several other brands to follow suit. Today, names like Flash Coffee, Jumpstart, Jago Coffee, and Tomoro Coffee are becoming increasingly popular among coffee enthusiasts, particularly those looking for quality beverages at affordable prices.

Kopi Kenangan, the pioneer of this trend, disrupted the traditional coffee market by offering affordable yet proper cups of coffee. They focused on providing quick and convenient service, with a strong emphasis on the “grab-and-go” concept. This approach resonated with many Indonesian consumers, especially urban dwellers who lead busy lifestyles and appreciate accessible and affordable options.

Following the footsteps of Kopi Kenangan, we are seeing many players in the scene, each with their own unique offering:

The Rise and Fall of Cloud Kitchens

The pandemic contributed to the rise of online food delivery in Indonesia, which in turn boosted the rise of cloud kitchens. Due to physical limitations and the closure of dine-in restaurants, food delivery emerged as the primary solution for customers, aside from cooking their own meals. As the demand for food delivery continues to rise, restaurants are compelled to rapidly expand their operations to accommodate customers in every residential area, then comes cloud kitchen. In 2020, the global cloud kitchen was valued at around USD 30.7 billion and is expected to hit USD 71.4 billion by 2027 with a 12.8% CAGR from 2020 to 2027. As a comparison, the global online food delivery market size in 2020 was estimated at around USD 136 billion, indicating that cloud kitchens contribute around 22.5% of the whole online food delivery market.

Cloud kitchens, also known as ghost kitchens, are commercial kitchens that operate without a traditional storefront or dine-in area, focusing solely on preparing food for delivery.

In Indonesia, the rapid growth of online food delivery platforms has created a significant opportunity for cloud kitchens to address the challenges faced by traditional brick-and-mortar restaurants. By eliminating the need of physical storefront and reducing overhead costs, cloud kitchens can offer affordable and high-quality food products to consumers. Additionally, cloud kitchens can quickly expand their operations and reach new markets by partnering with online food delivery platforms. The thesis of cloud kitchens in Indonesia is that they can offer a more efficient and scalable model for food production and delivery, creating significant opportunities for entrepreneurs and food businesses to enter the market and meet the growing demand for online food delivery services.

Cloud kitchens have evolved into various models that cater to the needs of different food entrepreneurs and consumers.

The independent cloud kitchen model is a single-brand kitchen with a delivery-only establishment. Independent cloud kitchen models typically sell food and beverages with a margin, similar to conventional foodservice business.

The multi-brand cloud kitchen model employs a shared commercial kitchen to reduce operational costs per brand. The brands under the multi-brand cloud kitchen usually still lies under one company. Their revenue model is similar to that of the independent cloud kitchens.

The co-working cloud kitchen model rents kitchen space to multiple 3rd party brands, earning money by charging rent to business owners, similar to office co-working spaces.

Below are several notable players in the cloud kitchen industry.

*data as per 2023

Cloud Kitchen Business Post-Pandemic

Data from CB Insights concludes that the global cloud kitchen industry received a total funding of USD 519 million in 2019, representing a 13-fold increase from the early days of cloud kitchens in 2018. Despite the roaring excitement throughout the peak of the pandemic, many cloud kitchen startups in Indonesia have struggled to stay afloat and shut down since. One of the main reasons may be the intense competition in the food delivery market, which has driven down prices and margins, coupled with the rising cost and reduced customer incentives from food delivery platforms.

Another possible reason could be the change in consumer behavior as the pandemic comes to an end. The pandemic and resulting lockdowns led to a surge in demand for online food delivery, which in turn led to a rapid growth of cloud kitchen startups. However, as the situation gradually returns to normal, consumer behavior is expected to shift again. With more people dining out and returning to in-person experiences, the demand for food delivery may decline. This trend is reflected by Grab’s performance, as they experienced a 4% decrease in deliveries (including GrabFood) GMV to USD 2,350 million in Q1 2023 from USD 2,438 million in Q1 2022. Recognizing the slowing growth of the cloud kitchen business model, some players such as Grab Kitchen and DishServe made the decision to shut down their operations.

Grab Kitchen

Grab was one of the first company to introduce the concept of cloud kitchen in 2018. The idea was to provide Grab’s F&B merchants with a solution to meet rising market demands by expanding their coverage area without the need for a significant capital investment. During its initial days, several businesses such as Calais Bubble Tea, Pondok Sate Pak Heri, Sop Buntut Ibu Samino, and more joined Grab Kitchen. Grab partners with food court operators to offer spaces for its merchants.

After 6 months of operation, Grab Kitchen operates 10 cloud kitchens in Jakarta and Bandung, with a target of reaching 50 cloud kitchens by the end of 2019. In 2020, Grab had 48 cloud kitchens operating around Indonesia and partnered with more than 200 local F&B brands. However, in December 2022. Grab is announcing the closure of its Grab Kitchen service after 4 years of operation, citing inconsistent growth and a shift to an asset-light business model as the reasons.

DishServe

DishServe, a cloud kitchen network company, was launched during the pandemic when online food delivery was on the rise. DishServe aims to help restaurants reach a wider market and expand their distribution points. DishServe raised an undisclosed seed round from Insignia Venture Partners.

After over 2 years of operations, DishServe announced a pivot in February 2023. DishServe focused more on operational automation in their partnered kitchens including restaurants, cafes, and delivery-only kitchens. The pivot was due to the realization of the low margins that the cloud kitchen business model offers.

Unfortunately, despite having more than 200 partnered kitchens, DishServe’s CEO, Rishabh Singhi, announced the closing down of the business in May 2023 due to a thinning runway and the inability to secure much-needed funding.

This phenomenon is not only unique to Indonesia with F&B businesses around the world are facing similar challenges. In India, Swiggy, an online food delivery platform, recently sold its cloud kitchen business due to slowed growth, despite receiving a total funding of USD 3.6 billion from 16 funding rounds. Swiggy was a pioneer in the cloud kitchen model with Swiggy Access launched in 2017. Swiggy Access enabled restaurants to partner with kitchen spaces in areas where they lack physical storefronts, increasing the restaurant’s delivery coverage. What was a necessity during the pandemic now seems superfluous without social distancing and stay-at-home policies in place.

Remaining Optimistic

Despite the shutdowns of many F&B businesses, many investors are still bullish on and remain active within the sector. These new investments show that despite the challenges faced by older players, there is still optimism and interest in the market:

Flash Coffee

In May 2023, Flash Coffee closed its series B round totaling USD 50 million from White Star Capital, Citadel International Holdings, Vulpes Ventures, etc. The fund will fuel Flash Coffee’s expansion plans, enabling them to establish a stronger presence in Indonesia’s coffee market.

Flash Coffee distinguishes itself by focusing on the quality of its coffee beans. They take pride in sourcing premium beans. Despite the emphasis on quality, Flash remains committed to keeping their prices affordable making it an attractive option for coffee enthusiasts who value both taste and money.

Legit Group

Legit Group just raised USD 13.7 million series A in April 2023 led by MDI Ventures with participation from SMDV.

Legit Group is a cloud kitchen multi-brand operator with 4 brands under them; Sek Fan, Pastaria, Ryujin, and Sei’Tan. The company leverages customer perception data and cutting-edge technology to optimize kitchen resources, reduce food costs, and improve food delivery efficiency. Legit Group seeks to identify and acquire high-quality food SMEs, integrating them into their existing infrastructure to scale up operations quickly. With their focus on innovation, customer satisfaction, and operational efficiency.

iSeller

iSeller received USD 12 million series B from Intudo Ventures, MCI, KVision, and Openspace bringing their total disclosed funding to USD 20 million.

iSeller is a comprehensive and user-friendly POS and e-commerce platform that empowers businesses to streamline their operations, manage inventory, and sell products. The platform also offers features such as sales analytics, customer management, and marketing tools to help businesses optimize their sales strategies and enhance customer experiences.

Desty

In January 2023, Desty secured a seed funding round of USD 4.4 million, with East Ventures leading the investment. This funding brought Desty’s total seed funding raised to USD 12.6 million.

Desty is also offering a digital ecosystem solution for restaurants from product management, ordering system, to consolidated report. Through Desty Menu, Desty helps businesses to increase their productivity and reduce their lead time.

Uena

UENA, a hyperlocal online F&B startup based in Indonesia, has raised an undisclosed seed funding round led by East Ventures in September 2022. UENA is a one-brand cloud kitchen company. It consolidates the most favorite everyday menus in one place and sells affordably for daily food necessities.

Uena addresses the issue of high daily food spending faced by Indonesian customer. The company’s value proposition is to offer affordable meals at a price of only IDR 15,000 per meal. Uena leverages its supply chain efficiency to minimize sourcing and delivery costs while increasing productivity through automation.

Ultimately, most VC-backed F&B businesses still struggle to really take off as they lack the proper industry experience and operational excellence know-how specific to the industry. Most VC investors are instead more well-versed in networking and rapid scale-ups. That said, today’s post-pandemic era brings a unique opportunity for these F&B startups to navigate through rapidly changing customer demands and reshape the future of the F&B industry. A constant trial and error will be necessary to determine what is essential to the economy and what is simply another trend. It will be interesting to see how these players utilize their latest funding and whether their business models can retain customer loyalty, stay relevant, turn a profit, and sustain long-term growth; or if they will simply follow in the footsteps of their many predecessors. Only time will tell and how we all wish we have a time machine to see what’s coming.