From Hero to Zero to Hero (Again)

The Resurgence: How Iconic Brands Overcome Downfall

In the history of corporate industry, several brands were once heralded as industry titans. Their meteoric rise seemed unstoppable. However, a series of missteps and miscalculations plunged these once-mighty brands into the brick of extinction. Yet, against all odds, they managed to rise from the ashes, proving that even the greatest business failures can be rebuilt with the right blend of courage, innovation, and strategic thinking.

Abercrombie & Fitch was one of the fashion darlings of the 1990s, a popular destination for American shoppers. Wearing clothing emblazoned with "Fitch" or "A&F" was considered a status symbol. In the Eastern part of the world, Luckin Coffee emerged as a leading modern coffee chain, offering a convenient option for customers. It became the go-to options for caffein seeker and it exists in every corner of the country.

These industry darlings, once highly successful, faced challenges that threatened their existence. Despite experiencing declines in performance and existential issues, they demonstrated remarkable resilience and achieved a resurgence.

Abercrombie & Fitch: The King of Fashion in 90s and 00s

Abercrombie & Fitch’s hoodie was the ultimate status symbol in the Y2K. The brand was synonymous with cool, preppy, attractive, and muscular models. Its moose logo was splashed across high school students to young adults. During its peak, the company reached USD 4.5 billion in 2014 annual revenue.

In the late 1990s and early 2000s, Abercrombie & Fitch was more than just a clothing brand, it was a lifestyle. With its dimly lit stores, thumping music, and shirtless models, the brand created an aura of aspiration. The company’s strategy was clear: ”sell not just clothes, but a sense of belonging to an elite, carefree group”. Prices were high, but so was the demand. However, Abercrombie’s advertising was provocative and bold, often sparking conversation and controversy.

Challenges and Controversies: A Downward Spiral

As Abercrombie & Fitch's popularity soared, so did scrutiny over its exclusionary practices, including hiring and sizing. CEO Mike Jeffries publicly targeted only 'cool' and 'attractive' customers, leading to accusations of promoting unrealistic body images, racism, and sexism.

The rise of social media and shifting consumer values further exacerbated Abercrombie’s decline. Shoppers began seeking out brands that aligned with their values, including inclusivity, diversity, and authenticity. Abercrombie failed to follow the change in customers’ value. Sales plummeted, and the brand reputation took a hit. To make matters worse, the rise of fast fashion offered consumers cheaper alternatives to Abercrombie’s premium prices.

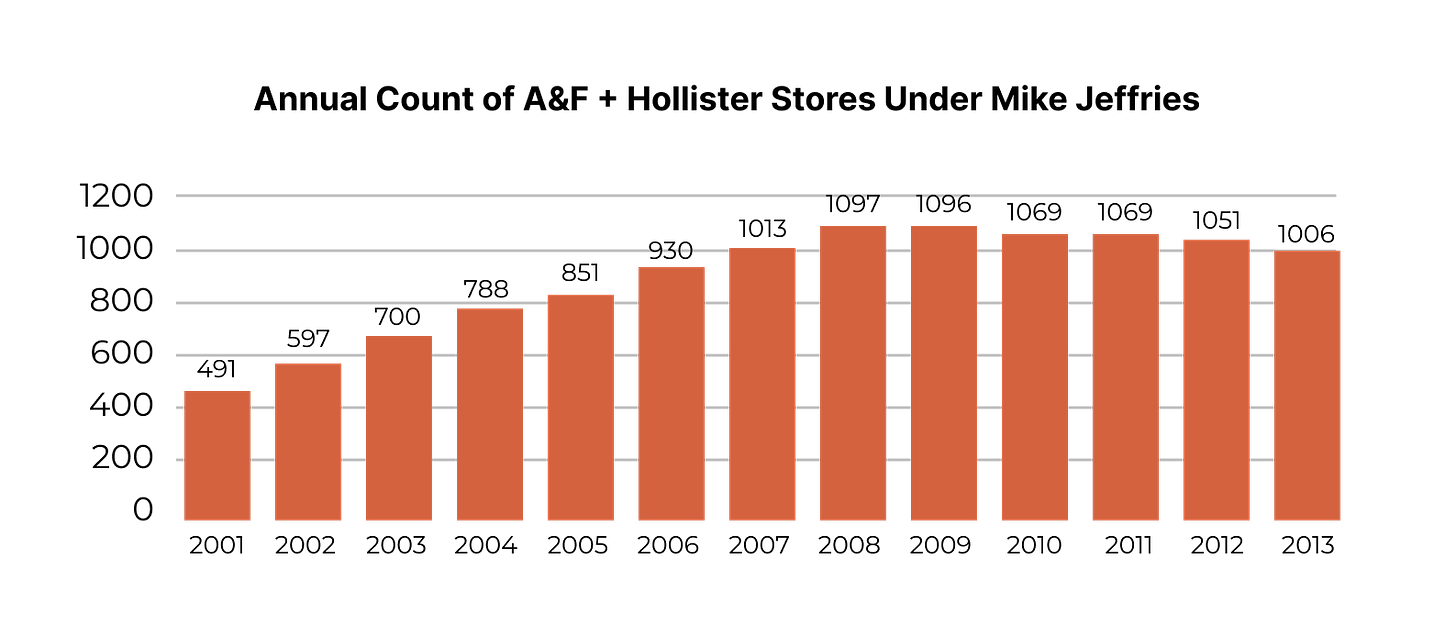

Despite the continued depression in the same store sales growth (“SSSG”), the Company under the helmet of Mike was aggressively expanding its outlet footprints to offset it and eventually increase their top-line.

Against the fashion market that go more massive production, faster, cheaper and produce value-for-money clothing, Abercrombie went the opposite by going more exclusive. However, their bottom-line did not lie, it plummeted deep to only ~2% in 2013 before Mike sign off as the CEO.

Not only the profitability of the Company, the confident of the investors in the stock market towards the company dropped from 2007-2016.

The Rebirth: Embracing Inclusivity and Modern Retail

Mike Jeffries’ brand philosophy came under intense scrutiny as the cultural landscape began to shift. His controversial remarks and policies led to a widespread backlash. In 2014, Mike Jeffries stepped down as CEO of Abercrombie & Fitch. In 2017, Fran Horowitz, who had been with the company since 2014 as President and Chief Merchandising Officer, was appointed CEO.

Under the leadership of Horowitz, Abercrombie & Fitch has worked hard to rebuild trust with consumers. The company has expanded its sizing options, embraced diverse models in its advertising. The result? A brand that feels more in tune with today’s consumers, who value substance over style alone.

Recognizing the need to change, the brand undertook a comprehensive rebranding strategy. Gone are the hyper-sexualized ads and exclusionary practices. In their place is a focus on inclusivity, diversity, and a more sophisticated, understated aesthetic. The brand’s stores have been redesigned to be more inviting, with a focus on customer experience rather than creating an exclusive club-like atmosphere.

In addition to shedding the brand’s controversial past, Horowitz has played a crucial role in guiding Abercrombie & Fitch through embracing modern retail’s omni-channel strategy. In 2017, the retail industry was undergoing significant changes with consumers increasingly favoring online shopping and expecting seamless experiences across multiple channels. Horowitz led efforts to enhance Abercrombie’s e-commerce platform and social media engagement.

As Abercrombie & Fitch’s rebranding efforts began to take hold, the positive impact on the company’s financial performance became increasingly evident. In 2023, the company once again reached over USD 4.2 billion in annual revenue. The company’s share began to climb, reflecting renewed investor confidence in the brand’s future prospects. The company’s shares reached all time high in June 12, 2024 to USD 192.34.

The Comeback Of Luckin

It looked like game over for Luckin. But this was just the beginning of their story.

One of the first actions taken by Luckin Coffee was to remove its CEO Jenny Zhiya Qian, who were found to be involved in the accounting fraud. The company appointed a new CEO, Jinyi Guo, who took over the reins in May 2020. Under the new management, Luckin undertook major restructuring strategy.

Luckin Coffee's rise in 2019 was fueled by an aggressive "loss leader" strategy. The company doled out free coffee and steep discounts to rapidly expand its customer base. New customers were eligible for free coffee while existing customers could get up to 80% discount. Luckin's pricing is way below Starbucks's normal price, with an average price per cup of coffee at USD 1.4 compared to Starbucks's USD 4.5

While this tactic successfully garnered a massive following, it proved unsustainable. The majority of Luckin's customers were primarily driven by convenience and price, not necessarily a deep-rooted love for coffee. As a result, when the company attempted to raise prices, customer retention dwindled.

To steer the company back on course, new leadership implemented a comprehensive turnaround strategy:

A key focus was cost reduction, achieved by closing unprofitable stores, slashing marketing expenses, and streamlining operations. The emphasis shifted from rapid expansion to optimizing existing stores. Luckin cut down stores from 4,507 stores in 2019 to 3,929 in 2020.

The company's marketing approach also underwent a transformation. Shifting from heavy discounting to brand building, Luckin successfully repositioned itself as a trendy and aspirational brand. By targeting a younger demographic and collaborating with influencers, the company cultivated a loyal customer base.

Product innovation emerged as a game-changer. While competitors stuck to traditional coffee, Luckin experimented with bold flavors, creating a new category of coffee drinks that resonated with Chinese consumers, transforming coffee from a bitter brew into a delightful treat. This product-centric approach allowed Luckin to launch a staggering 113 new products in 2021 alone, compared to Starbucks' 20. Luckin's innovative beverage lineup not only captured the market but also enabled the company to increase prices without sacrificing sales volume, demonstrating the power of product differentiation.

The company adopted a dual strategy, operating stores in major cities and franchising in smaller markets. The success of their new product line made franchising attractive, leading to rapid store openings. With this scheme, Luckin coffee opens one new store within average 1.9 hours in 2023.

During pandemic, while Starbucks struggled with it dine -in model, Luckin's focus on omni-channel, delivery and takeout proved to be a winning formula.

Through a combination of strategic pivots and operational excellence, Luckin Coffee has demonstrated remarkable resilience. In 2023, Luckin Coffee has surpassed Starbucks China revenue by around USD 500 million. On top of that the Company has successfully switched from “loss leader” strategy depending on promotion to become a business operating and trading at net income. The company's journey serves as a case study in how to overcome adversity and achieve sustained growth.

Bluebird: The Top of Mind in Taxi Services

One other example of brand turnaround is Bluebird. Bluebird, Indonesia’s iconic taxi company, has long been a trusted name in the country’s transportation sector. Founded in 1972, the company built a reputation for safety, reliability, and service quality, making its distinctive blue taxis a common sight on the streets. Minimum innovation was needed as Bluebird was the only obvious choice for reliable and safe taxi service.

However, the landscape of the transportation industry underwent a seismic shift with the rise of on-demand ride-hailing services like Gojek in 2016. These innovative platforms offered unparalleled convenience, affordability, and a user-friendly experience, disrupting the traditional taxi business model. People now do not need to wait on the streets to spot a vacant taxi car.

Bluebird saw its market share erode as more consumers, primarily the younger ones, opted for the convenience and cost-effectiveness of ride-hailing apps. Bluebird’s financial performance began to suffer as it struggled to compete with the aggressive pricing and promotions offered by its tech-savvy rivals.

The Turnaround: Strategic Adaptation and Reinvention

Faced with these challenges, the company recognized the need for a strategic pivot to remain relevant in the evolving transportation market. The company embarked on a series of initiatives aimed at modernizing its operations, enhancing customer experience, and leveraging technology to compete with ride-hailing services.

Partnerships with Ride-Hailing Platforms. Rather than seeing the newcomers as competitors, Bluebird chose to collaborate with them. In 2017, the company partnered with Gojek, integrating Bluebird taxis into the Gojek app, allowing Gojek users to book Bluebird taxis from the app.

Launching MyBluebird. The app offered many of the features that consumers had come to expect from ride-hailing services such as on-demand taxis, cashless payments, and real- time tracking.

Expanding service offerings. Bluebird has been adding electric vehicle fleets. This addition has helped the company to stay competitive in the more environmentally conscious customers.

The Secret Sauce of Brand Turnaround?

While the stories of A&F, Luckin Coffee, and Bluebird serve as inspiring tales of corporate resurrection, they also highlight the precarious nature of business in an era of rapid technological change, intense competition, and the ever-present threat of fraudulent activity.

The ability to pivot, adapt, and learn from mistakes has proven to be a crucial factor in the success of these companies. All companies demonstrated remarkable agility in responding to market shift and consumer preferences. Moreover, the courage of their leadership to acknowledge past errors and embrace new strategies was instrumental in their recovery.

The comebacks of A&F and Luckin Coffee are examples of the crucial role human resources play in the life of a brand. Central to this transformation was a change in people-most notably, the appointment of a new CEO who brought fresh vision, strategy, and values to the company.

Do you think A&F, Luckin Coffee, and Bluebird's transformations offer a blueprint for long-term success, or do they risk repeating past mistakes as they navigate an ever-changing market landscape?