From Horsepower to Hypercharge: Electric Vehicle’s Century-long Journey To Game-changing Batteries

THE HISTORY OF BATTERY-POWERED VEHICLE

When Tesla introduced its lithium-ion-powered car in 2008, it catalyzed significant excitement and anticipation within the automotive market regarding electric vehicle (“EV”). The Tesla car had the next-gen battery technology capable of transversing distances exceeding 300 km on a single charge and its acceleration surpassed many internal combustion engines (“ICE”). Nonetheless, it is worth noting that the concept of EV traces its roots back to the 1800s, a historical fact often overlooked by many.

Towards the conclusion of the 19th century, electric vehicles accounted for 40% of the automotive market in the United States. However, at that time there were many factors that hindered Electric Vehicle dominance:

Limited in battery capacity persisted resulting in restricted travel ranges typically spanning between 30 km to 60 km;

The decline in gasoline prices rendered gas-powered vehicles more economically viable and efficient alternatives;

Advancements in gas-powered vehicle technology led to quieter operation and reduced vibration, enhancing their appeal to consumers; and

Environmental concerns regarding global emissions had not yet emerged as a significant issue during that period.

Thus, with all superiority, the gas-powered vehicles continued to dominate and finally made the electric vehicle disappear from the road in early 1900s. Gas-powered cars ruled the road for years, while electric vehicle development (R&D to extend battery capacity) was almost forgotten. Many people nowadays are too young to know that electric-powered cars (previous gen with limited performance) were once a popular mode of road transportation.

Nowadays, the resurgence of interest in EV can be attributed to several key factors:

Heightened global awareness and a growing demand for environmentally-friendly and sustainable modes of transportation;

Significant advancements in battery technology, facilitating the production of batteries with larger capacities capable of enabling extended travel distances exceeding 300 kilometers. Additionally, these advancements have contributed to making EVs more financially accessible to consumers;

Better Charging Infrastructure to reduce “Range Anxiety”

Government Incentives and Subsidy

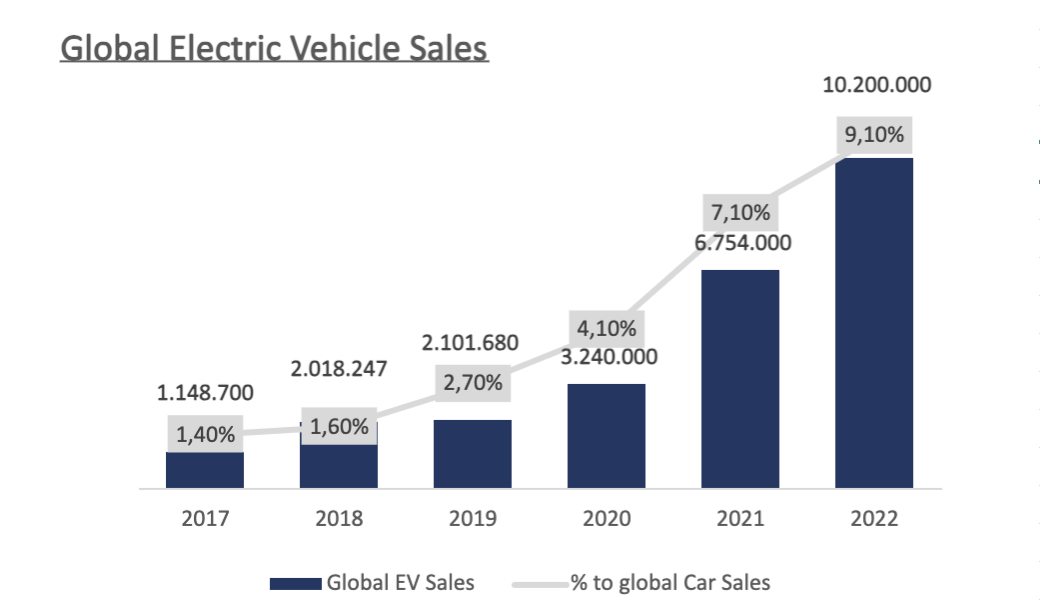

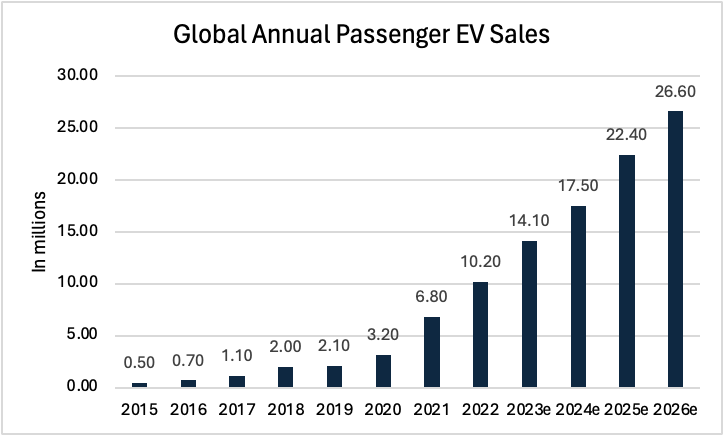

GROWTH OF GLOBAL EV INDUSTRY

In 2022, electric vehicles sector hit USD $384 bn in market revenue. The volume makes up ~9% of total vehicles sold in operation globally, an increase from ~7% in 2021. Notably, China holds the largest contribution accounting for ~58% of global sales. As EV sales continue on an upward trajectory, it is expected for EV market share to surpass the gas-powered vehicles and reaching 60% penetration in 2040. We will deep-dive into factors underpinning this projection in the subsequent sections.

At present, the global EV market is led by Chinese giant BYD and the US’ Tesla. Well-established German automakers including Volkswagen, Mercedes and BMW have also sold significant amounts of EV units.

Global BEV players

THE RISE OF BYD

Leveraging robust domestic sales in China and burgeoning international demand, BYD solidified its remarkable transformation, surpassing Tesla as the world's leading electric vehicle (EV) manufacturer in the fourth quarter of 2023. This achievement underscores the company's journey from a mobile phone battery supplier to a global EV leader.

Founded in 1995, BYD initially focused on manufacturing lithium-ion batteries for leading mobile phone companies like Motorola and Nokia. In 2003, they embarked on their automotive journey by acquiring Xi'an Qinchuan Automobile and launched their first car in 2005. Notably, Warren Buffet's Berkshire Hathaway invested USD $230 million in 2008. Since then, BYD has launched several successful hybrid and pure electric vehicles, renowned for their innovative blade battery offering good energy density and safety. The release of the Han sports sedan in 2020 marked the start of their rivalry with Tesla.

With aggressive overseas expansion plans, BYD is poised to further challenge Tesla's dominance in the rapidly evolving EV landscape. Since 2020, they have achieved major expansion in Europe and Asia-Pacific, and this year, finally, their arrival in Indonesia with prices ranging from IDR. 425 million to IDR. 719 million has made the EV market more accessible.

In a move to accelerate the adoption of electric vehicles (EVs) within Indonesia, PT Bank Mandiri (Persero) Tbk has established a strategic partnership with BYD. This collaboration offers financing services for expanding the EV ecosystem, demonstrating Bank Mandiri's commitment to sustainable economic growth through environmentally friendly initiatives. They will provide various financial support and strategic services to BYD, including optimizing financing subsidiaries. The aim is to support Indonesia's transition to net zero carbon emissions (NZE) by 2060 by accelerating the Green Economy through sustainable financial products and financing development.

UNVEILING INDONESIA’S EV POTENTIAL

Indonesian electric vehicle market value reached IDR. 7.93 trillion in 2020. Since that year, EV adoption has witnessed significant growth, particularly from 2021 to 2022 for four-wheeler vehicles. For two-wheeler vehicles, EV penetration is lower but steadily increasing.

We will deep-dive the factors driving the increase in EV adaption, particularly focusing on the Indonesian market.

FACTOR 1: DEMAND FOR MORE ENVIRONMENTAL-FRIENDLY AND SUSTAINABLE TRANSPORTATION

The transitions to sustainable mode of transportation i.e. electric vehicle are expected to cut down the global emission, considering the road vehicles contribute approximately 18% of global emission.

2022 Global Carbon Emissions

Top 10 Global Carbon emitters (contributing to 72.4% of global emission)

Indonesia ranks among the top 10 countries globally responsible for approximately 72.4% of total carbon emissions, underscoring its significant contribution to environmental impact on a global scale.

Several nations, including Indonesia, entered formal agreements to expedite the reduction of greenhouse gas emissions (GHG)[MC1] [CK2] . Below are notable initiatives involving the transition to battery- or electric-powered vehicles.

· Paris Agreement: This historic agreement, endorsed by 196 countries, seeks to limit global warming to under 2°C (ideally targeting 1.5°C), compared to pre-industrial times. Although the agreement does not explicitly mandate any transition into electric vehicles (EVs), it advocates for low-carbon technologies, such as electric transportation. Numerous national climate action plans have been submitted under this accord and have included specific objectives and actionable measures to promote EV adoption.

· Net-Zero Coalitions: Several nations, businesses, and other entities (Indonesia among them), have pledged to achieve net-zero emissions by 2050 or earlier. Within these coalitions, members have committed to electrifying their transportation sectors, thereby substantially advancing EV adoption.

· ASEAN Climate Change Initiative (ACCI): Established in 2009, through this initiative, ASEAN leaders committed to the development of a regional EV ecosystem in efforts to lower emissions.

FACTOR 2: MORE AFFORDABLE PRICE AND BETTER BATTERY PERFORMANCE

EV cars available in Indonesia are used to be presumed as luxurious and less accessible due to the high price that used to double the conventional cars. However, since 2023 there are several newcomer brands emerging in the market offering prices less than IDR. 500 million, making them a more affordable option to many consumers. Furthermore, electric motorcycles are only 13% higher on average than conventional, which makes them more accessible for many consumers.

While price has been a major barrier, another significant concern for consumers to switch to EV is how far they can travel in a single charge. This “range anxiety” has been an issue since the early days of electric vehicles, dating back to the 19th century.

By now, battery technology has significantly improved over the years, leading to an increase in range capacity. Modern EVs can now travel more than 300 km on a single charge compared to the earlier generation that travelled only 30-60 km on a single charge. This improvement in range and price addressed a fundamental concern for consumers, making EVs more viable option for everyday use.

FACTOR 3: BETTER CHARGING INFRASTRUCTURE

Beyond advances in battery technology, readily available charging infrastructure is equally crucial in alleviating "range anxiety," as a major barrier to widespread EV adoption. By addressing this concern, it creates a stronger incentive for people to consider purchasing an electric vehicle.

In Indonesia, there are mainly three charging station type by location.

Stasiun Pengisian Kendaraan Listrik Umum (SPKLU)

EV charging stations are now available at some gas stations in Indonesia. These stations offer a convenient and accessible way for EV drivers to charge their vehicles on the go, similar to the experience of refuelling conventional vehicles. As of Jan-24, PLN data indicates 1,081 SPKLUs spread across Indonesia. Of these, 843 units belong to PLN, with the remaining 238 built by partners and the private sector. To support the growing adoption of electric vehicles, PLN is actively expanding its SPKLU network. Their goal is to have 24,729 SPKLU units operational throughout Indonesia by 2030.

Malls

Several forward-thinking malls in Jakarta are leading the charge by offering dedicated parking spots for electric vehicles, complete with readily available charging infrastructure. This provides a convenient and hassle-free experience for EV owners visiting these malls, encouraging wider adoption of electric mobility. Charging station is available in Senayan City, AEON Mall Serpong, Tangerang City Mall, Citywalk Cikarang, Pluit Village and many more.

Convenience Store

Beyond traditional charging stations, several innovative startups are playing a key role in building Indonesia's EV infrastructure. One of the innovations are battery swapping infrastructure for electric two-wheelers. Unlike conventional charging stations, users can quickly exchange depleted batteries for fully charged ones, significantly reducing wait time and addressing range anxiety. Some of the startups focusing on this innovation are Swap Energy, Oyika and Electrum (joint venture between TBS Energy and GoTo). Swap Energy has boasts over 1300+ swap spots across Indonesia and Oyika has partner up with Alfamart to install battery swapping station within their stores. Overall, these efforts from both startups and established players illustrate the diverse and dynamic landscape of EV infrastructure development in Indonesia. By offering innovative solutions like battery swapping and integrating charging into daily routines, these initiatives contribute significantly to accelerating the adoption of electric mobility in the country.

FACTOR 4: GOVERNMENT INCENTIVE AND SUBSIDY

The government subsidy and initiatives are closely linked to its commitment to reducing greenhouse gas emissions as also pledged in previously mentioned agreements e.g. Paris Agreement, Net Zero Coalition, among others.

Two- and three-wheelers EV

As of March 20, 2023, the Indonesian government is providing a subsidy incentive for electric motorcycles amounting to IDR. 7 million per unit. This program will run from 2023 to 2024, with 200,000 units subsidized in 2023 and 600,000 units in 2024.

To qualify for the subsidy, one of the most important requirements is to meet the TKDN requirement. Here are the TKDN regulations for battery-based EV with two and/or three wheels:

· 2019 to 2026: Minimum TKDN of 40%

· 2027 to 2029: Minimum TKDN of 60%

· 2030 and beyond: Minimum TKDN of 80%

Four-wheelers EV

In April 2023, a subsidy for electric cars was also implemented. In practice, the incentive is given in the form of a Value Added Tax (PPN) reduction through the Ministry of Finance Regulation Number 38 of 2023. The amount of the PPN incentive is based on the TKDN (Tingkat Komponen Dalam Negeri or Minimum Local Content). The values are as follows:

· 5% for TKDN 20% (buses)

· 10% for TKDN 40% (buses and cars)

Here are the TKDN regulations for battery-based EV with four or more wheels:

· 2019 to 2021: Minimum TKDN of 35%

· 2022 to 2026: Minimum TKDN of 40%

· 2027 to 2029: Minimum TKDN of 60%

· 2030 and beyond: Minimum TKDN of 80%

The government has relaxed the minimum TKDN requirement for subsidies on electric vehicles. Previously, a minimum of 40% TKDN was required until 2024. This change aims to attract more investors to the Indonesian EV industry.

In additional, government will roll out more tax incentives in February 2024, including the removal of luxury taxes on EVs for the fiscal year 2024 and any import taxes until the end of 2025.

Overall, incentive subsidies have a positive effect on EV demand and sales. This is because the majority of customers are still price sensitive and tend to choose the vehicle that cost them the least.

FINAL THOUGHTS: SECTOR CHALLENGES, WHAT MAKES IT DIFFERENCE THAN 19th and 20th CENTURY SOLUTION

Overall, the trajectory of EV development and adoption has significantly evolved since their inception in the 19th century. Modern EVs have experienced a resurgence driven by various factors. Elevated concerns over global warming prompted governments to commit to reduce carbon emissions exemplified by initiatives like the Paris Agreement and the net-zero coalition. Governments worldwide have also implemented incentives like subsidies to encourage EV adoption, underscoring the urgency to transition towards sustainable transportation.

Additionally, EV technology has notably improved: the battery capacity of EVs now offer ranges that address previous concerns of "range anxiety" and EV charging infrastructure is more accessible and widespread. Collectively, these factors have propelled remarkable EV adoption.