How Slowing Consumer Spending is Threatening the Retail Industry in Asia

The Eid al-Fitr celebrations have historically been associated with increased consumer spending and travel. However, in 2025, this pattern has shifted. During Eid al-Fitr 2025, consumer spending in Indonesia was reportedly to decrease by 12.3% from IDR 157.3 trillion the previous year to approximately IDR 137.97 trillion. According to The Ministry of Transportation’s estimates, the number of Eid travelers decreased by 24% to 146.5 million from 193.6 million last year.

Slowing retail sales across Asia

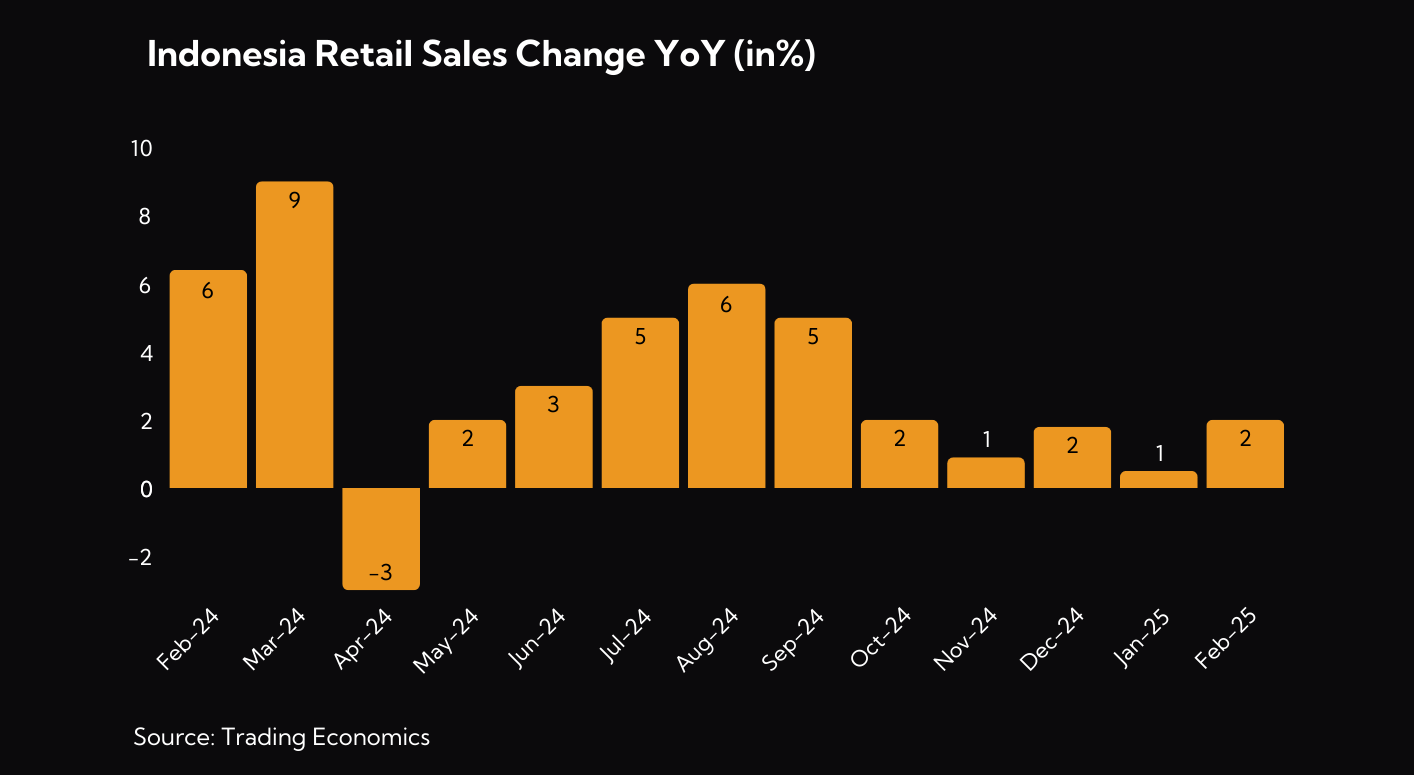

In January 2025, Indonesia’s retail sales increased only by 0.5% YoY, marking the slowest pace of growth since May 2024. This growth was primarily driven by sales in the food sector, which saw a 2.5% rise, and fuels, which experienced an 8.8% increase. However, other categories such as clothing and automotive parts & accessories reported slower growth compared to the previous month.

Indonesia’s experience mirrors a broader trend observed in other countries. The Asia-Pacific region is experiencing a notable decline in consumer spending. This trend is evident across various countries including Indonesia, Hong Kong, and China.

In February 2025, Hong Kong’s retail sales experienced a significant decline, marking the 12th consecutive month of decreases. The value of retail sales dropped by 13% YoY to HKD 29.4 billion (USD 3.8 billion), while the volume of sales decreased by 15% representing the largest drop since April 2024. Notably, sales of jewelry, watches, and valuable gifts fell by 14%. This downturn is attributed to reduced spending by shoppers, a decrease in overnight visitors from mainland China, and an increase in local residents spending abroad influenced by the strength of local currency.

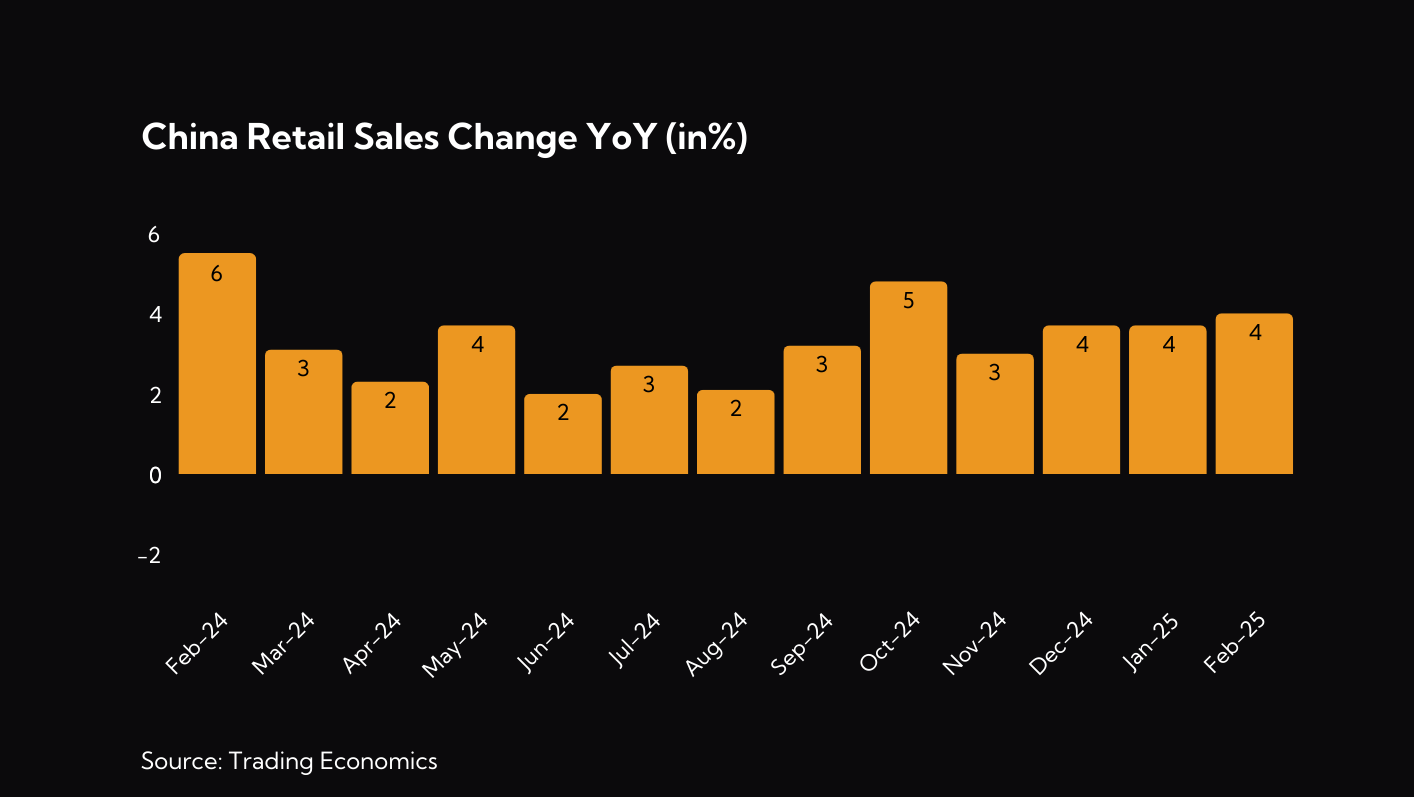

On the other hand, China saw a pickup in retail sales. Retail sales increased by 4.0% YoY, up from December’s 3.7% growth and marking the fastest pace since November 2024. This uptick is largely attributed to heightened spending during the Lunar New Year holiday. Although the increase was lower than last year’s Lunar New Year where the country saw a 5.5% growth in February 2025.

Other than the week-long holiday, the uptick was also due to the 300-billion-yuan consumer goods trade-in program by the Chinese government. This initiative aims to stimulate spending by encouraging consumers to upgrade appliances, electric vehicles, and other goods. The move aligns with Beijing’s broader strategy to shift economic growth away from exports and investment toward a more sustainable, consumer-driven model. In addition, the government has introduced targeted monetary subsidies—such as direct cash incentives and tax breaks—to lower the effective cost of new purchases, making them more accessible to a broader segment of the population and reinforcing domestic consumption as a key growth engine.

Key Factors

The ongoing geopolitical tensions, trade wars, and tariffs imposed by US have contributed to rising global production costs. These external pressures have led to disruptions in supply chains, increased raw material prices, and greater uncertainty in global trade flows. As a result, many countries in Asia are grappling with imported inflation, where the cost of goods rises not due to domestic demand but because of external shocks and policy barriers. This situation has particularly affected sectors reliant on imported inputs or cross-border trade, further amplifying price pressures on both producers and consumers.

Inflation is one of the primary drivers behind the recent slowdown in retail sales growth across Asia. As inflation rises, it erodes the purchasing power of consumers, leading to tighter household budgets and reduced discretionary spending. In many countries, higher prices for essential goods such as food, fuel, and housing have left consumers with less money to spend on non-essential items.

For example, in Hong Kong, inflation has been creeping upward, with the consumer price index (CPI) increasing by 2.9% YoY in 2024 compared to 2.1% YoY growth in 2023. Food prices increased by 2.5% from 1.8% increase in prices for food at home and 3.6% increase in prices for food away from home.

In contrast, Indonesia’s inflation rate is reaching the lowest point in the past couple of years, with 0.76% in January 2025, even recording a deflation of 0.09% in February. The decline was largely attributed to subdued demand, as evidenced by a downward-trending Consumer Confidence Index (CCI), a delayed effect of the previous period’s high inflation and slowing economic growth.

As inflation continues to weigh on economies, especially in food and fuel prices, consumers are becoming more selective in their purchases, prioritizing essentials and cutting back on discretionary items. Retailers are increasingly facing pressure to balance price increases with demand, making inflation a crucial factor in the broader retail landscape across the region.

One of the significant factors contributing to the slowing growth of retail sales is slower wage growth, which limits consumers' purchasing power and discretionary spending. Despite Indonesia’s relatively low inflation in 2024, wages have not risen as quickly, reducing the disposable income available for non-essential purchases.

According to BPS (Badan Pusat Statistik), the average monthly wage for Indonesian workers in August 2024 was Rp 3.27 million, marking a modest 2.81% increase compared to the same period in 2023. This slower wage growth means that while the cost of living has remained relatively stable, households are not experiencing significant increases in income to support higher spending levels.

This is a common observation during a period of stagflation whereby Companies cut labor costs to stay profitable. As a result, salary increase tends to be low and sometimes Company even needs to reduce workforce by laying off workers.

These economic pressures have forced Indonesia’s middle class, contracting it significantly. Between 2019 and 2024, the middle-class population declined by approximately 9.5 million people, dropping from 57.3 million to 47.8 million, now constituting just over 17% of the total population. The shrinking middle class poses a substantial challenge to Indonesia's economic stability, as this group has traditionally been a key driver of consumption and growth.

The impact of slower wage growth can be observed in sectors where discretionary spending is crucial, such as fashion, electronics, and dining out. Retail sales in categories like clothing and automotive parts have experienced sluggish growth, as workers' incomes have not kept pace with the rising costs of goods and services in other areas, such as housing, utilities, and education.

A significant factor contributing to the slowdown in retail sales across Indonesia and other Asian countries is weak consumer confidence. When consumers feel uncertain about the economy, job security, or future financial conditions, they tend to limit spending, particularly on discretionary sub-sector. This is due to the increasing inter-temporal margin of substitution (benefit of consuming later is higher and people is more incentivized to save now. This behavior amplifies the inflation and low wage growth that resulted in the contraction in retail sales.

In Indonesia, the Consumer Confidence Index (CCI), remained weak in 2025. The index showed a decline to 126.4 in February 2025, marking a 3-month low, signaling increasing concerns about economic conditions. The fall in consumer confidence can be attributed to fears about job security, rising debt levels, and global uncertainties, which have led households to focus more on savings than on spending.

The decline in retail sales across Asia is having a profound impact on the retail industry, with both short-term and long-term consequences for businesses, employment, and economic growth. Retailers are facing a series of challenges as consumer spending slows, forcing them to adapt to the changing landscape or risk falling behind in an increasingly competitive market.

In 2024, FMCG company Unilever Indonesia faced a significant challenge reporting a 9% YoY decline in sales attributed to reduced consumer demand. The company's market share in Indonesia decreased to 34.9% from 38.5% the previous year, as consumers shifted towards more affordable local brands like Wings Group and Mayora Indah. This trend reflects a broader consumer movement towards cost-effective options amid economic pressures and geopolitical tensions.

As retail sales slow, many businesses are feeling the pressure on their profit margins. With less demand for non-essential goods, retailers are often forced to discount products to attract customers, further squeezing margins. In response, some retailers are focusing on cost-cutting measures, reducing inventory, and even scaling back on expansion plans to manage cash flow more effectively.

The retail sector’s struggles are also leading to store closures and job losses. Many brick-and-mortar retailers are closing stores in areas where foot traffic has significantly decreased. Retailers are also reducing their workforce in response to the slowing demand. With fewer customers coming through the door, businesses are scaling back their staffing levels, which could lead to increased unemployment in the retail sector. This does not only affects the employees but also has a ripple effect on the broader economy, especially in countries where retail is a significant employment sector.

Conclusion

The combination of inflation (mainly cost-push), negative sentiment on the future income/earnings, slower wage growth, and shifts in consumer behavior has led to reduced retail spending. As a result, retailers are facing mounting pressure on profit margins, leading to store closures and workforce reductions. Therefore, retailers must adapt to this condition and changing consumer preference.

Given the cautious spending behavior of consumers, retail businesses need to adjust their product offerings to emphasize value, affordability, and quality, while also being mindful of the growing trend toward sustainability and ethical consumerism.

Governments and businesses must work together to restore consumer confidence, whether through targeted economic stimulus measures, improved job security, or incentives for spending. Strengthening consumer sentiment is essential for long-term retail growth.

The shifting dynamics present a unique opportunity for local businesses to thrive. As Indonesia's middle class adjusts to tighter budgets, consumers are increasingly seeking value-for-money alternatives. With the right pricing strategies, localized branding, and distribution reach, domestic businesses are well-positioned not only to gain market share but also to strengthen national economic resilience amid global uncertainty.

In conclusion, while the current retail slowdown presents challenges, it also offers opportunities for innovation and adaptation. By responding to shifts in consumer behavior, focusing on value, and embracing digital strategies, businesses can position themselves for long-term success, even in the face of economic uncertainty.