Luna Crypto Crash: How UST Broke, Why It Matters, and What's Next

How UST Broke, Why It Matters, and What's Next?

Crypto investors mourn as Luna Coin lost 99% of its value from $116 in April to less than a penny in the middle of May 2022. To understand why the crash happened, we must first understand the concept of stablecoins.

Stablecoin is a type of cryptocurrentcy where the price is pegged to a more stable currency (for example the US dollar), formed as the solution of cryptocurrencies’ high price volatility.

Luna Coin is a cryptocurrency tied to the third largest stablecoin TerraUSD ($UST). UST maintains its price pegged to the USD through Luna Coin and billions of dollars in Bitcoin. The mechanism between the 2 coins (Luna and UST) were supposed to work so that investors could hedge against the volatility of the crypto- currency by trading one for the other if one went under the pegged price, swapping $UST coins with a free-floating Luna Coin to control supply. If Terra traded for less than $1, people could exchange it for $1 worth of Luna. The chaos started when over $2 billion worth of UST was unstaked (taken out of the Anchor Protocol), and hundreds of millions was immediately sold. The massive sells pushed the price down to $0.91, traders tried to take advantage of the arbitrage exchang- ing $0.91 worth of UST for $1 worth of Luna Coin, but as regulated by Terra to control Luna’s worth through avoiding over-supply, only $100 million worth of UST can be burned for Luna per day, creating havoc and panic between traders.

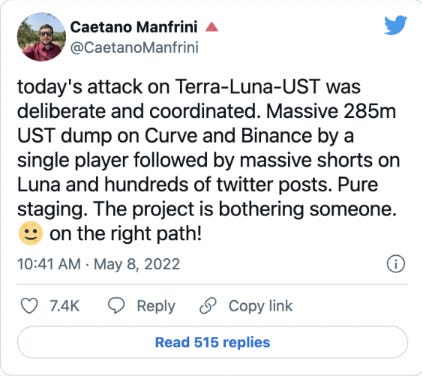

What triggered the massive UST sells remained unknown. Some people suspected that it was the act of a particular someone, naming the culprit “evil genius”, who is betting the UST price to go down so they could profit from shorting Bitcoin. But it could also be the reaction to a particularly volatile period such as interest rates going up in effort to cool off inflation.

“While it was too early to say if the momentum for the crash was created by collusion, it appeared ‘exploitative’. Conspiracy theorists would say ‘yes’, because it is a massive trade. I mean, in all of my career, it is one of the biggest trades that I have seen. It’s almost like an evil genius plot, because there are a lot of steps to it” - Lisa Wade, CEO of DigitalX

Over $15 billion in crypto value have been wiped out through Luna and UST. Social media platforms are flooded with grief and panic. Many who had a huge portion of their savings staked in UST and consequently lost everything have posted that they are contemplating suicides.

Do Kwon, the creator of TerraUSD and LUNA, is now the subject of criticism and investigation after the failure of his enterprise. MoneyToday reported that an unidentified individual broke into the apartment complex where Do Kwon’s wife resides and inquired about the founder.

This incident raises the market's distrust for stablecoins as investors and traders wonder if what happened to UST can also happen to other stablecoins. The panic created by Luna-UST caused other coins such as Bitcoin to plummet over 10% over the course of 3 days after the crash (May 11th – May 14th). Many investors lost faith in cryptocurrencies and are now reconsidering their act to put their savings on crypto, thanks to scary tweets from Luna-UST investors. According to CoinMarketCap, the entire cryptocurrency market now has a market capitalisation of USD 1.2 trillion, less than half of its USD 2.9 trillion market cap in November 2021.

This incident raises the market's distrust for stablecoins as investors and traders wonder if what happened to UST can also happen to other stablecoins. The panic created by Luna-UST caused other coins such as Bitcoin to plummet over 10% over the course of 3 days after the crash (May 11th – May 14th). Many investors lost faith in cryptocurrencies and are now reconsidering their act to put their savings on crypto, thanks to scary tweets from Luna-UST investors.

According to CoinMarketCap, the entire cryptocurrency market now has a market capitalisation of USD 1.2 trillion, less than half of its USD 2.9 trillion market cap in November 2021.

OCBC NISP Ventura

May 2022 Newsletter