Q3 2023 Tech Earnings

As the third quarter of 2023 financial reports start rolling in, the tech earnings landscape is showing a mixed bag of results.

GoTo Q3 2023 Earnings

PT GoTo Gojek Tokopedia Tbk (IDX: GOTO)

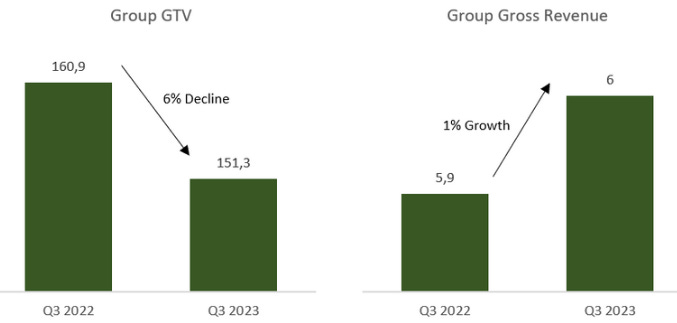

In Q3 2023, GOTO, experienced a 6% reduction in its group GTV, with figures declining from IDR 160.9 trillion in Q3 2022 to IDR 151.3 trillion. Nonetheless, the business had a 1% YoY growth in group gross income, from IDR 5.89 trillion in Q3 2022 to IDR 5.98 trillion in Q3 2023. This mainly due to the increase in their take rate which experience an 8% increase, jumping from 3.7% in Q3 2022 to 4,0% in Q3 2023. However, GOTO ultimately went through a 22% reduction of group’s net revenue, dropping from IDR 4.60 trillion in Q3 2022 to 3.60 trillion in Q3 2023. It happens due to the increase of incentives to the customer which previously stands at 0.8% of GMV in Q3 2022 to 1.8% of GMV in Q3 2023.

Breaking down the business segments, there were declining GTV of 12%, 11%, and 3%, respectively, from Q3 2022 to Q3 2023 for on demand services, e-commerce, and financial technology respectively. Moving on to gross revenue, on-demand services remained stable at IDR 3 trillion, while e-commerce gross revenue increased by 5% from IDR 2.1 trillion to IDR 2.2 trillion. Financial technology's gross revenue remained constant at IDR 0.4 trillion, and there was a 17% decrease in logistics gross revenue, which fell from IDR 0.6 trillion in Q3 2022 to IDR 0.5 trillion in Q3 2023.

The most notable aspects of GOTO Q3 earnings were evident of their cost saving initiatives. IT development and infrastructure costs dropped by 13% for the corporation, from IDR 0.8 trillion in Q3 2022 to IDR 0.7 trillion in Q3 2023. Additionally, the business was able to successfully reduce its overall fixed operating expenditure from IDR 2.5 trillion in Q3 2022 to IDR 2 trillion in Q3 2023, a 20% reduction.

BUKA Q3 2023 Earnings

PT Bukalapak Tbk (IDX:BUKA)

In Q3 of 2023, BUKA, reported its total payment volume (TPV) at IDR 41.06 trillion, experiencing a 1% decrease from the Q3 2022 IDR 41.31 trillion. Despite the modest decrease in TPV, the company's revenue increased by 29% from IDR 0.90 trillion in Q3 2022 to IDR 1.16 trillion in Q3 2023. This exceptional revenue gain was supported by a notable improvement in the overall take rate, which increased from 2.17% in Q3 2022 to 2.82% in Q3 2023.

Breaking down the revenue sources, BUKA generated IDR 0.56 trillion from O2O services and IDR 0.64 trillion from its marketplace activities during the third quarter of 2023. Ultimately, the company displayed a positive shift in net profit, moving from a loss of IDR 4.97 trillion in Q3 2022 to a loss of IDR 0.39 trillion in Q3 2023, marking a significant 92% improvement.

SEA Q3 2023 Earnings

Sea Limited (NYSE: SEA)

In the third quarter of 2023, SEA Limited demonstrated positive financial performance across key metrics, showcasing a commendable growth trajectory. The company's overall revenue experienced a 5% increase, rising from USD 3.2 billion in Q3 2022 to USD 3.3 billion in Q3 2023. This growth was mirrored in the total gross profit, which surged by 17%, reaching USD 1.4 billion in Q3 2023 compared to USD 1.2 billion in the same period the previous year.

A significant contributor to SEA's success was the robust performance of its e-commerce platform, Shopee, which witnessed a substantial 16% increase in revenue from USD 1.9 billion in Q3 2022 to USD 2.2 billion in Q3 2023. The digital entertainment segment, Garena, also experienced positive growth, with revenue expanding by 11% from USD 0.53 billion to USD 0.59 billion during the same period. Furthermore, SEA's digital financial service, SeaMoney, demonstrated remarkable growth, achieving a 36% increase in revenue from USD 0.33 billion in Q3 2022 to USD 0.45 billion in Q3 2023.

Due to all these positive trends, SEA Limited successfully reduced its net loss by a significant margin, decreasing it by 75% from a loss of USD 0.57 billion in Q3 2022 to a loss of USD 0.14 billion in Q3 2023. This improvement in net loss reflects SEA's strategic efforts and effective financial management during the specified period.

GRAB Q3 2023 Earnings

PT Grab Teknologi Indonesia Tbk (IDX: Grab)

In the third quarter of 2023, Grab reported steady growth in key operation metrics. Grab's GMV showed a 5% increase, rising from USD 5,080 million in Q3 2022 to USD 5,341 million in Q3 2023. The company also experienced a 7% growth in MTU, with figures climbing from 33.5 million users in Q3 2022 to 36 million in Q3 2023, reflecting a strong user base.

Grab's impressive financial performance is further evident in its revenue, which surged by 61% from USD 382 million in Q3 2022 to USD 615 million in Q3 2023. This was driven by the significant increase of take rate which jumped from 7.50% in Q3 2022 to 11.50% in Q3 2023, marking an impressive 53% growth and showcasing Grab's ability to capture a larger portion of each transaction's value. The revenue breakdown for Q3 2023 shows a variety of income sources, with deliveries contributing USD 306 million, mobility generating USD 231 million, financial services bringing in USD 50 million, and enterprise and new initiatives accounting for USD 28 million.

Furthermore, Grab demonstrated improved financial sustainability by reducing total incentives from 9.40% of the GMV in Q3 2022 to 7.10% of the GMV in Q3 2023, marking a significant 24% decrease in expenditure associated with incentives. Lastly, Grab narrowed its net loss substantially, with a 71% reduction in net losses from USD 342 million in Q3 2022 to a loss of USD 99 million in Q3 2023, demonstrating its progress toward financial sustainability and positive performance.

META Q3 2023 Earnings

Meta Platforms Inc (NASDAQ: META)

In Q3 2023, META, achieved substantial revenue growth, with its total revenue earnings reaching USD 34.15 billion, a 23% increase compared to USD 27.71 billion from the previous year. This remarkable increase in revenue was driven by strong performance in advertising, which contributed USD 33.64 billion (~99%), increasing 23% from only USD 27.24 billion in Q3 2022.

On the profitability front, META also saw a significant jump in quarterly net profit, which soared to USD 11.58 billion, a remarkable 164% increase compared to the previous year's USD 4.39 billion. This boost in profitability was reflected in the net profit margin (NPM) as well, which rose from 16% in Q3 2022 to an impressive 34% in Q3 2023. The improvement was attributable to efficiency measures Meta took since 2022 including layoffs. Headcount was 66,185 as of September 30, 2023, a decrease of 24% YoY. Total costs and expenses were USD 20.40 billion, a decrease 7% YoY from USD 22.05 billion.

Despite the good earnings report, shares went down after call due to the company issued conservative Q4 guidance. In the earnings call, Meta CFO Susan Li said that geopolitical is leading to a softening ad market. Li also noted that the company is facing increased competition from other social media platforms, such as TikTok. Meta’s Q4 2023 projection for revenue is around USD 36.5 billion to USD 40 billion. The midpoint of that range, USD 38.25 billion was short of analyst expectation of USD 38.8 billion.

AMAZON Q3 2023 Earnings

Amazon.com, Inc. (NASDAW: AMZN)

Amazon maintained its strong financial growth in Q3 2023, bringing in a total revenue of USD 143.08 billion, 13% more than the USD 127.10 billion they brought in during Q3 2022. According to the Q3 2023 revenue breakdown, Amazon has a diverse revenue stream, with USD 87.89 billion coming from North America (NA), USD 32.14 billion from the international market, and USD 23.06 billion from the Amazon Web Services (AWS).

In addition to this notable increase in revenue, Amazon reported a remarkable surge in quarterly net profit, reaching USD 9.88 billion in Q3 2023, marking an extraordinary 244% increase from the Q3 2022 figure of USD 2.87 billion. This surge in profitability was also reflected in the net profit margin increasing from 2% in Q3 2022 to 7% in Q3 2023. This was attributable to efficiency in sales and marketing expenses as well as general and administrative expenses.

Amazon's robust financial performance in the third quarter of the year underscored the significance of Amazon Web Services (AWS) as one of the profit drivers for the company. AWS's operating income surged by an impressive 29% YoY, reaching USD 6.98 billion, comfortably surpassing Wall Street estimates, which had predicted USD 5.60 billion. However, the cloud revenue confirmed expectations from some Wall Street analysts that sales growth for AWS would stay relatively flat from the prior quarter. In addition to AWS, Amazon's advertising division continued to be a star performer, with ad revenue reaching USD 12.10 billion, marking a remarkable 26% increase compared to the same period in the previous year. This achievement exceeded analysts' projections of USD 11.60 billion.

APPLE Q3 2023 Earnings

Apple Inc (NASDAQ: AAPL)

Apple reported revenue of USD 383.29 billion for the fiscal year that concluded in September 2023, a 3% drop from the previous fiscal year's revenue of USD 394.33 billion, which ended in September 2022.

There were a few variations seen in the revenue breakdown by product in 2023 when compared to 2022. Notably, revenue from services climbed by 9%, compared to sales from iPhones declining by 2%, Mac revenue falling by a significant 27%, iPad revenue declining by 3%, and revenue from wearables, accessories, & homes down by 3%.

According to regional revenue analysis, most regions saw a drop in revenue between 2022 and 2023. The revenue figures for the Americas region were down 4%, Europe was down 1%, Greater China was down 2%, Japan was down 7%, and the rest of Asia Pacific showed a gain of 1%.

In terms of costs, in the fiscal year ending September 2023, the cost of sales amounted to USD 214.14 billion, marking a 4% YoY reduction from USD 224.55 billion.

All those factors conclusively affect Apple's net profit for the fiscal year, which reached USD 97.00 billion, representing a 3% YoY decrease from USD 99.80 billion in the fiscal year ended in September 2022. Nevertheless, the net profit margin remained consistent at 25%.

NETFLIX Q3 2023 Earnings

Netflix Inc (NASDAW: NFLX)

In Q3 2023, Netflix reported a total revenue of USD 8.54 billion, reflecting an 8% increase compared to the previous year's quarterly revenue of USD 7.93 billion. The revenue breakdown for Q3 2023 shows that the largest portion came from the US & Canada at USD 3.73 billion and followed by EMEA at USD 2.69 billion.

Netflix's net profit for Q3 2023 reached USD 1.68 billion, marking a 20% increase from the Q3 2022 figure of USD 1.40 billion. The net profit margin also increased from 18% in Q3 2022 to 20% in Q3 2023.

Netflix's boost in subscriber growth can be attributed to its crackdown on password-sharing and the introduction of a new ad-supported tier. In addition to this, the company has raised the prices for its basic and premium plans in the U.S. This strategic move contributed to the positive outlook presented by Netflix, as it forecasts an 11% revenue increase in the Q4 2023, reaching USD 8.69 billion. However, this projection falls slightly below Wall Street's expectations of USD 8.77 billion. Netflix also anticipates that net subscriber additions in the upcoming quarter will be similar to those in the third quarter, highlighting its ongoing efforts to maintain and expand its subscriber base.

ALPHABET Q3 2023 Earnings

Alphabet Inc Class A (NASDAQ: GOOGL)

In Q3 2023, Alphabet reported substantial financial growth with a total Q3 revenue of USD 76.69 billion, marking an 11% increase from the previous year's Q3 revenue of USD 69.09 billion. The revenue breakdown for Q3 2023 showcases the diversified income sources within Alphabet, majority of the revenue coming from Google search (USD 44.03 billion), followed by YouTube advertisement (USD 7.95 billion), Google network (USD 7.67 billion), Google cloud (USD 8.41 billion), and the rest coming from other sources.

Alongside this strong revenue performance, Alphabet significantly increased its quarterly net profit, which rose to USD 19.69 billion in Q3 2023, indicating a substantial 42% increase from the Q3 2022 figure of USD 13.91 billion. This enhanced profitability is also reflected in the net profit margin, which grew from 20% in Q3 2022 to 26% in Q3 2023.

Alphabet's recent financial performance demonstrated a significant comeback, with an 11% increase in revenue, marking the company's return to double-digit growth after more than a year. Moreover, Alphabet exceeded both sales and profit expectations, surpassing analysts' estimates. However, despite these positive results, the stock experienced a decline in extended trading, largely due to disappointing cloud revenue. Simultaneously, the company underwent targeted layoffs during the third quarter, including reductions in its news division (approximately 30 to 45 layoffs) and the self-driving car unit, Waymo, which has been expanding its driverless ride-sharing service.