The Paw-Sitive Trend of Furry Friends in Indonesian Homes

The bond between humans and animals has never been stronger.

In recent years, pet ownership has surged, transforming from a simple companionship to a lifestyle choice. People are not only welcoming more pets into their homes but are also investing significantly in their care, transforming the pet industry into a booming economic sector. Indonesia’s pet industry is experiencing a boom fueled by bigger disposable income and a shift in cultural attitude towards pets. More Indonesians are seeking emotional support and companionship through pets. Surveys indicate a very high pet ownership rate in Indonesia, with estimates around 72% of households having at least one pet.

Moreover, the surge in pet ownership is not only a cultural shift but also a significant economic trend. Indonesian pet owners are investing substantial amount of money each month to ensure the well- being and happiness of their furry friends.

Estimated* monthly expenditure for cat and dog owners (in IDR):

*) Monthly expenditure per pet owner varies greatly depending on what type of pet food is given, how routine the regular check-ups and grooming are, and how much the owner is willing to spend for pet accessories.

**) The Veterinary Care and Health Service amount is based on annual spending distributed per month

Factors of the Boom

Urbanization and lifestyle changes

As more Indonesians move to urban areas, the desire for companionship in the often isolating and stressful urban environment has increased. Pets provide emotional support and companionship, making them appealing to city dwellers.

Rising middle class

With economic growth and the rise of the middle class, more people have disposable income to spend on pets. This financial stability allows them to invest in pet care and maintenance.

Changes in value, cultural believes and declining birth rate

Millennials and Gen Z today often believe that they can achieve greater happiness by not having children. Without the need to pay for school fees or spend extra time caring for kids, many embrace the modern concept of DINKs (Dual Income, No Kids). However, these families often choose to have pets, adding to their sense of family

Loneliness during the pandemic

Being stuck at home made several people decided to adopt a friend for companionship during the pandemic.

Key Trend: Humanization of Pets

The way people view and treat their pets are undergoing a significant shift. We’re no longer just talking about “owning” a dog or cat – we’re welcoming them as cherished members of the family, showering them with love, and indulging them in luxuries once reserved for humans. The humanization trend manifests in several ways:

Premiumization of pet food: pet owners are increasingly opting for high-quality, human- grade cuisine, organic options, and specialized diets catering to specific needs.

Pet fashion boom: from adorable outfits to luxury accessories, the pet fashion industry is booming.

Treating pets like people: celebrating birthdays with pet cakes, throwing costume parties, and even wedding parties.

Pet grooming: People regularly send their pets to salons and spas to indulge their pets and enhance their skin and fur. These services often include baths, haircuts, nail trimming, and even more luxurious treatments such as fur dyeing and aromatherapy

Economic Impact

The rise in pet ownership has significant economic implications, contributing to the growth of the pet industry. Increased demand for pet-related products and services has led to the expansion of businesses catering to pet owners, including pet food manufacturers, veterinary clinics, grooming salons, and pet accessory retailers.

Pet Food

While the pet food market continues to expand, growth rates are flattening as the category matures. The Asia Pacific Pet Food Market reached USD 9.61 billion in 2022 and is expected to reach USD 12.41 billion, a modest 5% CAGR from 2022 to 2027.

As pet owners become increasingly discerning about their companions’ nutrition, the market has responded with a plethora of options tailored to diverse dietary needs and preferences. Several companies offer specialized diets tailored to specific breeds, age groups, or health conditions.

Additionally, the emergence of novel protein sources, such as insect-based and plant-based alternatives, reflects the industry’s commitment to innovation and sustainability. This diversification not only caters to the varied preferences of pet owners but also underscores the growing humanization of pets.

As pets are increasingly viewed as family members, owners are seeking out premium and specialized products.

One example is Compawnion, a lifestyle company dedicated to elevating the overall health and well-being of dogs and cats. Funded by East Ventures, this Indonesian company caters to the evolving needs of pet food options that prioritize fresh, high-quality ingredients.

Their flagship product, Pawmeals, features freshly frozen, cooked dog food, formulated with a focus on balanced nutrition and complete meals. Recognizing the convenience factor, Compawnion also offers UGO, a shelf-stable, preservative-free fresh wet dog food.

L Catterton, a leading global consumer-focused investment firm, has made strategic investments in the burgeoning pet food industry, recognizing its immense growth potential.

L Catterton’s investment in Drools Pet Food marked its entry into the Indian pet food market. Drools has established itself as a dominant player in India, offering a diverse range of products catering to different pet nutritional needs.

Transactions in the Space

Veterinary Clinics

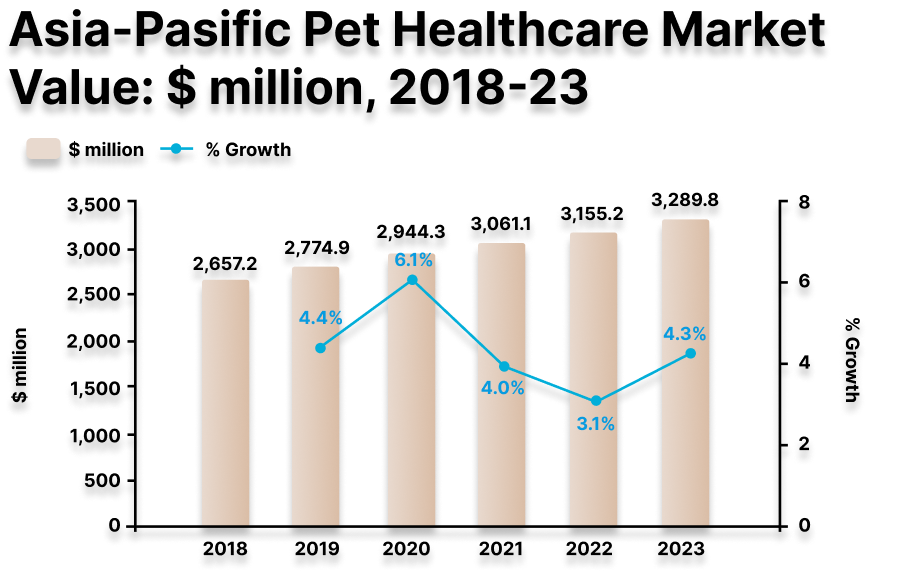

Veterinary clinics are seeing a boom as pet owners prioritize preventive care and invest in their pets’ well-being. The Asia-Pacific market value has increased significantly from USD 2.7 billion in 2018 to USD 3.3 billion in 2023. However, the market size is still considerably smaller than the pet food market.

As pet ownership surges, so does the demand for professional care. However, this burgeoning market is marred by a lack of standardization. This lack of uniformity in service quality, hygiene practices, and professional qualifications has led to a number of pet fatality cases.

Hygiene and sanitation issues: many traditional vet clinics struggle with maintaining adequate hygiene standards. This can lead to the spread of diseases among pets and pose risks to both animals and staff

Lack of qualified veterinarians: the demand for veterinary services exceeds the supply of skilled professionals

Limited access to advanced technology: traditional clinics often lack access to modern diagnostic equipment and treatment modalities, hindering their ability to provide comprehensive care

Rising expectations: as pet owners become more educated about animal welfare, their expectations for veterinary care have risen

In response to these challenges, companies like Medivet and Modernvet are redefining the industry by offering a different approach to pet care. With 3 outlets and growing, Medivet disrupts the traditional vet clinics by offering standardized qualified and clean medical expertise equipped with advanced technology such as CT Scan, USG, X-ray, and laser therapy.

Withmal serves as a pioneering example of veterinary services group. Withmal has built a team of vets in a steadily growing but fragmented veterinary service market in Japan. Of the nearly 13,000 pet clinics in the country, the vast majority are small, independently owned businesses. Many of these clinics are operated by veterinarians in their 50s or older who lack formal succession plans. Withmal offers a potential exit strategy for these veterinarians, allowing them to retire while ensuring the continuity of their practices.

Grooming Salon and Pet Hotels

While the pet care industry offers essential services for pet owners, there have been distressing incidents where pets have tragically lost their lives while under the care of grooming salons or pet hotels. These cases often involve negligence, abuse, or inadequate care. These cases are making it harder for pet owners to choose care for their beloved fur babies.

Most grooming salons and pet hotels operate as small- scale, single, or dual-outlet businesses. Businesses in this sector have struggled to expand beyond a single outlet due to these challenges:

Maintaining standards across multiple locations.

Ensuring consistent quality of service across multiple outlets can be difficult. Unlike vets with their degree, there is no standardized quality assurance for groomers and pet handlers. Factors such as staff training, product sourcing, and adherence to standard operating procedures can vary significantly

Local market saturation.

The pet care industry, especially in urban areas, can be highly competitive. This is exacerbated by the strong loyalty pet owners often exhibit towards their chosen groomers. Once a pet owner finds a groomer they trust, they tend to stick with them, making it challenging for new entrants to capture market share.

Financing challenges.

Scaling a grooming or pet hotels often requires significant capital investment, which can be difficult to secure, especially for smaller businesses.

Final Thoughts

The surge in pet ownership is more than just a passing trend; it's a reflection of growing affluence and changing lifestyles. As disposable incomes rise, people are increasingly willing to invest in their furry companions, creating a lucrative market for pet-related products and services.

While the pet food industry is a crowded space dominated by both global and local giants, the market is looking for a more premium personalized selection. On the other hand, the service sector presents a unique opportunity for entrepreneurship. Despite its size, it lacks a standardized, high-quality player. The veterinary sector is evolving towards more standardized practices and higher quality care, offering potential for specialized services.

The pet industry is undoubtedly a dynamic and promising landscape, ripe with potential for those who understand the evolving needs and desires of pet owners.