The Road to Homeownership: Navigating the Step-by-Step Breakdown of the Property Purchase Process

The process of acquiring a property is a complex endeavor that requires careful planning and execution. Whether through cash or mortgage, the journey to become a property owner can be long, but ultimately fulfilling.

With so many factors to consider, it is important to have a clear understanding of the steps involved in the process. In this article, we take a closer look on what are the important steps including the paperworks and financing to secure a property, particularly for a primary residential property.

Estimated Cost for a Homeownership

One of the first considerations in the journey is determining budget and financial capacity. This involves assessing current income and expenses, and considering any additional costs associated with purchasing and maintaining a property.

While owning a home can be expensive, budgeting can help future homebuyers manage their finances and plan for the costs associated with homeownership. There are a few popular guidelines for future homebuyers on determining the percentage of income to set aside for mortgage in their budgeting. Future homebuyers can determine how much of an installment they can afford by setting aside 25% - 28% of their monthly income. Other factors must also be considered when determining budget for mortgage, including savings, other expenses, and long-term financial goals.

After determining the budget, the journey goes on to determine which property to acquire. There are several things to consider when making this investment including the location of the property and its surroundings, the size and style of the house, condition of the property, and the price. It is also important to consider the potential for future growth and resale value of the property. By working closely with an experienced agent, a potential buyer can be presented with a range of options that align with their likings, lifestyle, and financial capacity. The agent can provide insights into the real estate market and help the buyer to assess the potential of each property. Additionally, a property agent may also help buyers to connect with banks for potential loan and to notaries for the legal works.

There are 2 types of property agents; agents who work for an agency, or in-house agents from the developers. From the buyer point of view, agent from an agency can offer a wider variety of properties and are not solely focused on promoting properties from a specific developer. However, an agent from the agency must also work with an in-house agent. On the other hand, in-house agents work directly for the developer may have in-depth knowledge about a particular primary project and may have easier access to help buyers with the financing and paperwork involved in the transaction. Buyer should not worry about the agent fees as it is the seller who pays, in this case the developer.

Digital agents have also emerged as a popular alternative to traditional property agents. Marketplaces such as Rumah123.com and Dekoruma Properti use advanced technology and data analysis to provide personalized property recommendations to buyers. In addition, the company also has agents that can assist buyers throughout the transaction process.

Homebuying Process at a Glance

Site Visit

When considering purchasing a home, a site visit is an important step to ensure that the property meets your needs and expectations. Site visit is a way for future homebuyers to examine the overall condition of the location, neighborhood, proximity to amenities, natural light, etc.

With the advancement of technology, some developers now offer a virtual site visit through 3D rendering and virtual reality technology. This technology was particularly important when the Covid-19 pandemic hit. However, the popularity of this technology subsided after physical restriction lessen.

Deposit: Buyer’s Commitment

Once a decision has been made, the next step is to pay a deposit called Uang Tanda Jadi (UTJ), a minimum of IDR 5 million payment serving as a demonstration of the buyer’s commitment to the transaction. The purpose of UTJ is to demonstrate the buyer’s seriousness and commitment to the transaction, and to lock the unit the buyer’s is going to purchase. UTJ that has been paid will reduce the down payment (DP) that must be paid and refundable when the transaction falls down.

Purchase Order

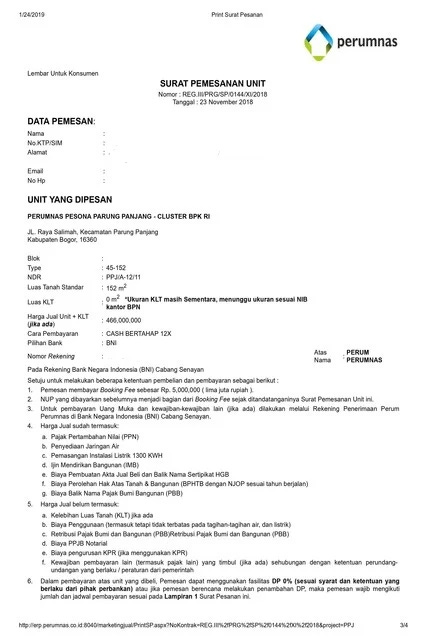

Typically, a week after the UTJ is paid, the buyer will sign a purchase order document, Surat Pesanan which outlines the terms and conditions of the transaction including the method of payment.

Down Payment

There are several options of payment, the methods available are also dependent on available promotions and bank partnerships from developers. Some developers offer a free down payment where buyers are not obligated to make the down payment at the beginning but pay it in installments to the developer per month. This scheme is targeting potential buyers who cannot afford the down payment, hence the developer will pay the down payment to the bank in advance, as bank requires down payment in order to take mortgage installments.

Sales and Purchase Agreement

After the down payment is paid, the next step is to sign the sales and purchase agreement, Perjanjian Pengikatan Jual-Beli (PPJB). PPJB is a preliminary agreement that outlines the terms and conditions of the sale of a property before the final deed of sale is signed and before the payment is fully settled.

The contents of a PPJB typically include the following information:

Identification of the buyer and the seller

Description of the property including its location, size, and other relevant details

Purchase price

Payment schedule including the amount and due dates for each payment

Date and conditions under which the buyer will take possession of the property

Legal obligations or responsibilities for both the buyer and the seller

Dispute resolution

Notary signature

Financing Option

It is important to understand the various financing options available to potential buyers including cash, mortgage, and personal loans.

Cash

Paying in cash is the simplest and most straightforward financing method, yet it is not the easiest to attain. Although paying the full purchase price upfront will transfer the property ownership to buyer immediately, buying with cash may not be an option for many people as it requires a large amount of savings or liquid assets.

Cash Installment

Installment cash is another popular financing option in Indonesia. It is a type of financing that allows buyers to pay for their property in installments to the developer, usually over a shorter period than mortgage. This option is a good option for buyers who do not have the full amount to pay for the property upfront and is not eligible for a loan from the financial institution (due to poor credit history, insufficient regular income, unstable employment, etc). The financing arrangement including interest rates, fees, and penalties are determined by the developer.

However, installment cash often comes with higher interest rates compared to other types of installments (mortgage and personal loans) as the financing is provided by non-traditional lenders who may charge higher rates to compensate for the risks involved.

Mortgage

Mortgage is one of the most popular financing methods for buying a property. A mortgage allows the buyer to finance the purchase price of the property by borrowing a large sum of money from a lender (bank) then makes regular payments to the lender over a period of time, typically 5 to 30 years.

One limitation of mortgage is that banks in Indonesia have been restriction from providing mortgages for land acquisition. However, this has changed with the annulment of POJK No. 44/POJK.03/2017 jo. POJK 16/POJK.03 on Lending Limitations for Land Acquisition as of January 1st, 2023.

Usually for mortgages, banks offer a fixed fee for a number of years then a floating rate for the rest. Floating rate fluctuates over time in response to changes in the market (BI rate). Compared to fixed rate, floating rate carries more risk. If interest rate increases, monthly mortgage payments can become more expensive, putting a strain on the buyer’s budget. Buyers usually do a refinancing once they hit their floating rate period. Refinancing is a financing method that allows homeowners to replace their existing mortgage loan with a new one to lower their monthly payments, change the term of the loan, or access equity in the property.

When buying a primary project from a developer, in-house agents will help with the mortgage application. However, there are several documents needed for these application processes such as identification card (for both buyer and spouse if married), tax identification number, marriage certificate, income tax PPh21 (SPT), bank statements, and family registration certificate.

The qualification for a mortgage depends on the bank’s standards and requirement, but the most important factor is the buyer’s financial stability and ability to repay the loan. Typically, banks focus on 3 things:

Gross Income

Total amount of money the buyer earns before taxes and other deductions. This is to determine if a buyer has the financial means to repay their mortgage on a monthly basis.

Debt-to-Income (DTI) Ratio

DTI Ratio is a calculation that compares a buyer’s total monthly debt obligations to their gross monthly income. This includes all forms of debt including car loans, credit card debt, and any other monthly payments. Banks prefer buyers with low DTI ratio as this indicates that they are in a better financial position to repay their mortgage.

Credit Score

A credit score is a numerical representation of a borrower’s creditworthiness based on information from the credit history including payment history, credit utilization, and the length of their credit history. Banks will do a SLIK (Sistem Layanan Informasi Keuangan) check to know the buyer’s credit history and score. Buyers with high credit score are considered more creditworthy and therefore more likely to be approved for a mortgage loan with favorable terms and conditions.

The choices of mortgage that can be taken depends on the bank partnerships the developer establish. A buyer can only take mortgage from designated bank partner. That is because the collateral received by the bank in the case of a primary property purchase is not a certificate of ownership but a PPJB hence banks only offer mortgages through their developer partners.

Key Handover & Deed of Sales and Purchase

When the development for the property is completed, the buyer will then receive the keys to their new property. Here, buyers will need to sign Akta Jual Beli (AJB) or the deed of sale. PPJB lays the groundwork for the final AJB. AJB is a legal document that serves as proof of property transaction and outlines the terms and conditions of the sale. AJB is a crucial document that is required for the transfer of ownership of a property. This document includes details such as the names of the parties involved, the description of the property, the purchase price, and any other relevant terms and conditions.

AJB is a legal document that must be signed before a notary public. During the signing of the AJB, the notary public will read the entire document aloud to the parties involved, explaining any legal terms in the document. This is to ensure that all parties fully understand the content of the AJB before signing it. The notary public will then ask the parties to sign the document in the presence of a witness (typically the property agent), and the notary public will affix their seal and signature to the document to certify its authenticity.

Final Step of Ownership: Land Deed

Before receiving the land deed there are several things that need to be done to ensure that the transfer of ownership is legal and legitimate. One important step is to engage the services of a PPAT (Pejabat Pembuat Akta Tanah), which is a land deed official appointed by the government to oversee and certify land transactions. However, in the case of purchasing a property from a developer, the developer is responsible for engaging the services of a PPAT. The PPAT will then issue a land deed, also known as Sertifikat Hak Milik (SHM).

SHM is the certificate of ownership proving that the buyer is the legal owner of the property. SHM contains information about the property as well as the name of the owner. It is a crucial document as it is the main document as evidence of ownership.

SHM is received by the buyer after the payment is completed. For those who pay in cash, they can immediately get their SHM from the developer after the developer completed the construction and obtained all necessary permits and licenses. However, for those who pay with mortgage, SHM will be kept by the bank as a collateral until all payments are done.

OCBC NISP Ventura

March Newsletter 2023