Used Car Marketplace: The ever-thriving industry

In 2020, the pandemic peaked, and the Indonesian economy slumped with -2.07% growth. People were facing financial constraints due to layoffs and car dealerships across Indonesia were put under lockdowns. The sales of new cars, a cyclical business by nature, were following the same trajectory as the economy – it fell by 44.5%, from 1 million in 2019 pre-pandemic to 578,000 in 2020. However, like many pandemic surprise success stories, it became an opportunity rather than a threat to the ever-thriving used autos industry.

The used cars industry has always been a widely traded good in Indonesia, exceeding the sales volume of new vehicles by 1.3 times even before the pandemic. As COVID-19 hit and paralyzed the economy, there was an initial dip in used car sales in the first 2 to 3 months, but the overall performance of the used car industry was not at all crippled. It only made it easier to penetrate the market as everything went online and the growth of demand in these online used car marketplaces were increasing up to 600% in 2020 alone. The growth is evident as 2 Southeast Asian used car startups namely Carsome and Carro emerged as unicorns last year and more recently, an Indonesian company, Autopedia Sukses Lestari (IDX: ASLC) went public on the Indonesian Stock Exchange.

As people gradually recover from the effects of the pandemic, they have shifted their preferences towards these 4 wheeled vehicles as it is seen to be a safer alternative, less prone to the virus spread. Brand new cars value drops around 15-20% on the first year after purchase and drops at a lower rate as it gets older, making used cars a significantly cheaper option. In addition, due to improved opportunities and affordability of cars in general, the demand of this preferable mode of transport, is projected to have a positive trend over the next decade.

Digital Disruption in the Used Car Space

Prior to the digital disruption in the automotive business, purchasing and selling a used car was a hassle, especially for first-time buyers and beginners. Sellers often find it difficult to advertise and find credible sales channels. Sellers often receive false inspection results, seemingly exacerbating the real condition of the car and hence offered unreasonable prices for their cars. It is no different on the buyer’s end, as there is no clear data record of the used car they wish to buy, and transparency is close to nonexistent requiring extra attention for inspections. Not to mention the effort and time consumed to compare prices between cars, which can be quite an inconvenience.

As tech automotive companies emerged, they began to solve the ultimate problem of distrust and transparency. Initially, they provided a simple marketplace connecting buyers and sellers. Today, they provide end-to-end services, from inspection, financing to after-sales service, streamlining the whole process of selling and buying a car. These companies add value by offering reliable data records of the vehicle through assessments by an in-house specialized team of car inspectors. These inspections can cover hundreds of points within the car's functionalities, allowing customers to know exactly what went wrong before it was reconditioned. Some even provide in-house certifications that guarantee their cars sold on their platform to be free of major accidents like fire or flood damage.

These platforms are cutting the traditional players, yet still giving them leeway in using their services. Carsome initially started as a C2B, buying used cars and selling them to traditional dealers, while also facilitating credit payments and financing through third parties for these dealers. They soon transitioned to focus more on C2B2C, not just buying but also selling directly to end customers, starting to act as dealers themselves, although auctions are still exclusive for dealers. Now, they buy and sell cars themselves without going through dealers which helps increase their low margins of currently charging just IDR 2-3 million for handling fees.

Autopedia Sukses Lestari, its competitor, selling under the brands JBA, Caroline and Cartalog for 2 wheeled vehicles, has implemented a similar method. In fact, it completely removed the intermediaries, giving anyone access to join the car auction, unlike Carsome and Carro which currently only allows its dealer network. Autopedia however, requires its auction members to deposit a sum of money, starting from IDR 10 million/car. On top of that, all of these used car platforms earn a chunk of their revenue from autos financing margins which can get as high as 20% of asset value for B2B financing in Indonesia.

Source: Momentum Works 2020 Report

The Need for Brick and Mortar

Source: Deloitte 2022 Global Automotive Consumer Study

A study by Deloitte showed that only 19 percent of Southeast Asian prefer to buy their vehicles partially or fully online. This number was higher in more technology-advanced countries like the US, China, and India. Although many car platforms have provided customers with an extensive 360-degree view of the car, most customers still feel the need to personally check the condition of the vehicles themselves. This includes having to look, feel, test-drive the cars, and have the car keys handed over to them in person during the buying process. Today these platforms have incorporated offline experience access through their own versions of showrooms or Experience Center, which fulfills customers’ demand for offline experience. Now, these companies are in a race to open more of these physical showrooms and grab a bigger piece of the pie.

Source: McKinsey Automotive Retail Consumer Survey (Germany, China, US)

Customer Journey

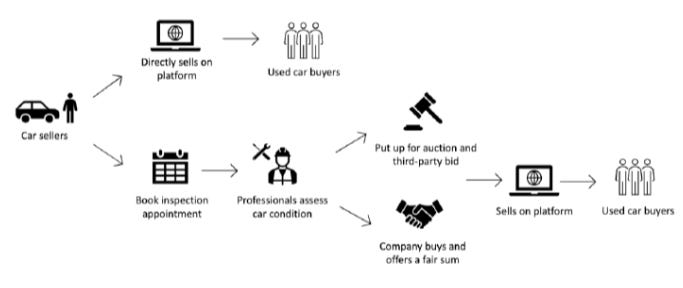

Each company has slightly different models. Some platforms like OLX Auto and Carousell Auto, allow anyone to list their cars directly on the platform; others require car sellers to book an inspection schedule and auction. A few platforms even offer both solutions, allowing sellers to choose the method that suits them best. Directly selling on the platform allows sellers to choose their buyers and negotiate prices themselves—a process that might be of value for some buyers but troublesome for others. Sellers will need to take pictures, advertise, meet prospective buyers, and specify the details of the car themselves. For that reason, the second option is more attractive to some. It lets companies handle the entire process, though prices might not be as negotiable as selling it directly on the platform.

The journey for the second option allows inspectors from the company to come to the seller’s place. The inspection process can take as little as 30 minutes and sellers are then offered 2 options whereby, they can either sell directly to the company for a sum offered by the company based on the assessment or put the car up for online bidding in real-time where it will be bid by the company’s network of users, whether it be their partners, dealers, or anyone depending on the platform’s system. Car owners are then given the freedom to choose one of both options and pick the highest offer in a limited amount of time as determined by the company. Once the deal is finalized, funds are directly transferred to the owners on the same day. Lastly, the company will handle the legal documents and the car will be moved to the company’s showrooms. The cars are reconditioned, and pictures would be taken for listing the car on the platform for potential buyers to check on virtually or physically through experience centers.

Final Thoughts

Amid the flourishing mega industry of used cars, big players are slowly grabbing the market share by providing transparency and cutting the intermediaries. The disruption has delighted the end customers, but it may not be as pleasant for the traditional used car players. The edge with traditional dealerships was their ability to bring in physical and in-person experience to potential customers. However, these tech companies identified that gap and are expanding their services, combining online and offline capabilities. Although these platforms are also helping these dealers source cars, will it stay that way in the long term? Are these platforms eventually going to dismiss them completely, making traditional car dealers obsolete? And what measures should these traditional players take to sustain their businesses?